12/9/2009

HEADLINES

2009 NIFS/West: Numbers Drop But Exhibitors Still Report Business

The recession took its toll on the 13th annual National Industrial Fastener Show/West as numbers dropped, but many exhibitors reported satisfaction with customers they met with.

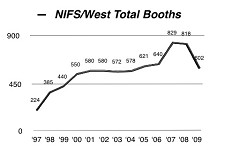

The number of booths fell 26.5% from 2008. Distributor registration was down 23.4%; overall registration fell 19.7% and overall attendee registration slipped 16.3% for the November 16-18, 2009, show at Mandalay Bay in Las Vegas.

NIFS pointed out that many trade shows reported drops in attendance of 30% or more. Some trade shows – including the 2009 NIFS/East – were cancelled for the year.

Exhibitors Grade the Show

“The show was good overall,” a multiple-booth exhibitor reflected. “Although attendance was lower, we still met with a number of customers.”

“The show was better than expected – though still below past levels but not ‘dead’.”

“It was the best show ever,” one veteran exhibitor declared. “We had breakfast meetings, dinner meetings, demos in the suite and we were slammed at the booth with happy customers and excited prospects. I couldn’t be happier.”

“Show was noticeably slower than recent years,” another exhibitor found.

“The show was what we expected – about 20% to 25% off.”

“I thought the show was a lot more lively than last year,” one exhibitor reflected. “We had a very busy booth and I was glad to see the improvement.”

One domestic manufacturer summarized the show as “rather unremarkable overall, nothing much different.”

“NIFS was a success for us,” a supplier with distribution and manufacturing customers reflected. “We added another person to our team this year and I’m glad we did. Except for a couple lulls all of us were busy.”

“The show was better than expected. I anticipated a low volume attendance due to the economy.”

“Our location was excellent and there was constant booth traffic until 1 p.m. the first day,” said an exhibitor who tracks stops at his booth and found it about half of the peak years. “The second day traffic was weak, but there were a few worthwhile visitors.”

“The show was great for us,” another exhibitor declared.

“For me, the show was smooth – everything was delivered on time, taken away in good time, nothing had to be changed and everything seemed to flow well.”

One exhibitor who expected the lower numbers said that he noticed “no extra effort” by show management to bolster attendance. While Mandalay Bay lowered hotel rates from $249 to $109 and neighboring hotels offered deals as low as $19, “show management didn’t match the effort by cutting the distributor registration fee. Nor did they bring in a celebrity speaker as STAFDA does.” He also said he didn’t notice any NIFS advertising in association publications or any creative promotion to counter the downward trend.

Though NIFS/West is primarily distribution-oriented there is a fastener machinery section and one of those exhibitors pronounced the show “good for us. We noticed like most, that the size of the actual show was smaller but the traffic was good.”

Another machinery exhibitor rated the 2009 NIFS/West as “a little better than last year – maybe it was just our booth location.”

Overseas Exhibitors

Numerous exhibitors complained about the number of overseas companies at NIFS/West and their claims may have been demonstrated by Nucor’s neighbors. In the 400 aisle where Nucor was located there were 23 foreign-based exhibitors and 13 domestic.

• A total of 54 of the 88 (63%) new NIFS/West exhibiting companies this year listed Asian addresses.

• A total of 145 of the 497 exhibiting companies listed in the 2009 Show Directory – or 29.2% – listed Asian addresses.

“More foreign booths and there are too many,” declared one attendee.

“I do not understand why so much of the show is Asian,” one domestic exhibitor questioned. “I think a lot more American companies may drop out of the show because of this situation.”

“The first thing I saw was the apparent increase in the number of countries represented as shown by the badges of those walking through,” a domestic manufacturer exhibitor observed. “Many Asians and some of those who exhibited approached us to encourage buying from them the same products we manufacture – ‘cheaper’ was the main point made.”

Suggestions

Exhibitors complained about a lack of candid communication from show management leading up to the show.

“OEMs, distributors and manufacturers learned years ago to openly share their numbers and projections to benefit the entire supply chain,” one exhibitor noted. “It lowers the cost of doing business at all levels.”

One exhibitor – who called FIN prior to the show for an explanation of NIFS’ advance registration numbers – complained that show management issued a series of distributor registration numbers with such terms as “surging” without ever putting them in a context that exhibitors could use to plan for the show.

“We need candid information six weeks, four weeks and two weeks out so we can decide how many brochures to print and ship and for staffing,” one exhibitor explained. “It could lower the cost of exhibiting without costing them (show management) anything.”

• Because of the high cost of furniture rental, another exhibitor suggested adding a basic furniture package to the booth price. He also suggested show management provide “at least a vacuum cleaning prior to the show – $42 dollars for the vacuuming of a 10×10 booth is insane … especially since it was made dirty by the show set-up people.”

• “We wanted water early on Tuesday and had to go downstairs for bottled water, until they opened upstairs. What people are not thirsty in Vegas?”

• Several exhibitors questioned the need for the 9 a.m. to 1 p.m. second day.

“The half day could well have been dispensed with. I do believe that a one-day show from 8:30 a.m. to 6 p.m. would do as well.”

One participant pointed out that show co-owner Mike McGuire’s booth was dismantled and abandoned before the closing bell and that “was evidence that the half-day is unnecessary.”

“Drop the half day,” a multi-booth exhibitor echoed. “All of the fastener shows I have attended are one-day shows, yet the second day is still scheduled. If the second day doesn’t benefit the exhibitor or the attendees, whom does it benefit? If the answer is no one, then why have it?”

• “Next year, I’d like to see the show provide an exhibitor’s lounge area, with free coffee, where we could grab a few moments away from the crowd. Many shows I’ve done in other industries do this and it’s very nice.”

• One suggested adding the monitors with paid ads to the lunch area to provide “lots more exposure.”

New Location?

Several exhibitors suggested moving away from Mandalay Bay after the 2010 NIFS/West.

One exhibitor said several others complained about Mandalay Bay being on the far south end of the famed Las Vegas strip and “too removed from the action and not as convenient as Paris was.”

“I miss the Paris Hotel,” another recalled of the first 10 years of NIFS/West at Paris/Bally’s. “Now we have to pay a taxi every time we want to go to the main strip.”

“I think the show probably has run its course of interest being held at Mandalay Bay,” said an exhibitor at almost every NIFS show. He noted the smaller show this year could fit into Paris’ smaller ballrooms.

The next NIFS/West is scheduled for November 8-10, 2010, at Mandalay Bay. Show management has yet to announce dates or location for 2011.

One participant who said that after 13 NIFS/West shows in Las Vegas it is time for a change of city. “Been there, done that,” he said of Las Vegas. “What about San Diego, San Francisco, Seattle, Vancouver or Denver? They all qualify as ‘West.’ They (show management) could learn from STAFDA, which over the same 13 years has shown us much of the nation.”

Another asked for the show to be moved away from Las Vegas because “the bean counters will never allow it for anyone except the most senior people.” He suggested Cleveland as the best show location.

“My only complaint – and it’s a big one – is Mandalay Bay. It is just too big!” said another exhibitor preferring the Paris Hotel.

Not a Penny

NIFS has held 41 distribution-oriented shows plus three OEM shows in 30 years and industry leaders continue to complain that show management has yet to write a donation check for any industry cause.

In his American Fastener Journal column, NIFS partner Mike McGuire described his dreams since the 1970s of an academic fastener research facility.

McGuire called on the industry to “come together to help the industry and advance the importance of fasteners and fastening design applications” by supporting a proposed Fastener Research Center at Ohio State University.

One past exhibitor noted that show management could mark their upcoming 30th anniversary by jump-starting a fastener center with a $300,000 donation. A bold donation could encourage the rest of the industry to contribute too.

“That is just $6,818 per show,” he calculated. Booths this year cost $1.795 to $1.895 each this year making the booth portion alone of NIFS sales in a down year over $1 million.

Several exhibitors have said that partly due to NIFS’ lack of financial support they are buying fewer booths, spending less on advertising and staying in non-NIFS hotels.

“They don’t realize exhibitors talk to each other. Columbus (NIFS/East) is at best an optional show for most of us and we are opting out because of show management’s attitude. They don’t ‘get it’ that never giving a penny is costing them money.” ©2009 GlobalFastenerNews.com

Related Stories:

• ‘World’s Largest’ Title Goes to Fastener Fair Stuttgart

• Activity

Related Links:

• NIFS

Share: