7/9/2012 12:01:00 AM

HEADLINES

Muted First-Half FINdex Includes Bright Spots

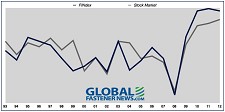

During the first six months of 2012 the FINdex lost 3.9%, compared to a 5.6% gain by an index of related industrial stocks.

Among those companies posting first-half share losses were such stalwarts as Fastenal, Nucor and Precision Castparts.

Fastenal’s stock struggled despite strong sales and profit growth as recently as May, when the company reported sales rose 18.4% to $274.8 million.

Those results followed a solid first quarter, when Fastenal sales soared 20% to $768.8 million, and net earnings grew 26% to $100.2 million.

For Precision Castparts, Fastener Products revenue grew 26% to $1.7 billion during fiscal 2012, which ended March 31, while operating income increased 19% to $488.1 million.

A few companies managed to achieve stock gains in the opening half.

B/E Aerospace topped the list, adding 12.8% in share value, a good portion of which was earned in the opening quarter.

In June B/E Aerospace doubled its consumables product portfolio when it agreed to acquire Interturbine Aviation Logistics GmbH, Interturbine Logistics Solutions GmbH, and Interturbine Technologies GmbH (collectively Interturbine), a provider of material management logistical services to global airlines and MRO providers, for EUR 200 million (US$251 million).

In the half Trimas finished a close second, with 12% in stock increase.

Other fastener companies with share value increases in the first six months of 2012 include Alcoa, Barnes, Chicago Rivet, Grainger, Park-Ohio and Paulin.

Lawson Products recorded the largest value loss in the half, losing 40% of stock value — nearly all of it in the second quarter.

Winners and Losers

After a promising start, the FIN Fastener Stock Index dropped off in the second quarter of 2012.

The FINdex declined 14.6% from the beginning of April to the end of June, bested by an index of related industrial stocks, which dipped a comparatively modest 3.4% during the period.

All public companies tracked by the FINdex lost ground in the second quarter.

Dorman Products was the hardest hit, losing half of its share value in Q2. The quarter capped a wild ride for Dorman, whose share value jumped 37% in the opening quarter of 2012 — the highest percentage gain in the FINdex — before plummeting one period later.

Other fastener companies losing 25% or more of public share value included Anixter, Fastenal and Lawson Products.

Canada’s H. Paulin weathered the quarter the best, losing only .049% in stock value in Q2. In the opening quarter Paulin’s share value increased 7.1%.

Other publicly-traded fastener companies whose Q2 share loss was in the single digits included Park-Ohio, B/E Aerospace, Barnes, Chicago Rivet, Carpenter Technologies, ITW and Precision Castparts.

In the opening quarter of 2012 the FINdex rose 12.3%, besting a 9.4% gain by an index of related industrial stocks.

Finding a middle ground proved difficult, as most public fastener companies achieved double-digit gains or suffered a loss during the period.

Dorman Products recorded the highest percentage gain in Q1, with its share value growing 37%.

Other publicly-traded companies with fastener operations gaining 20% or more included Anixter, B/E Aerospace, Fastenal and ITW.

By contrast, Kaydon Corp. stock dropped 16.3% in the opening months of 2012, while Lawson Products lost 2% in market value and Simpson Mfg. shares declined 4.2%.

The FINdex increased 9.5% in 2011, boosted by a 19.6% gain in the final quarter, when only one fastener company — Alcoa — lost ground on its share value during the period. ©2012 GlobalFastenerNews.com

Related Stories:

• Alcoa Reports Record Fastener Segment Margins

• Hillman Group President Rick Hillman Retires

Share: