10/23/2012 12:07:00 AM

NEWS BRIEFS

Grainger Results Show Strengthening Sales

![]()

Sales of $2.3 billion, up 8%, 10% on a daily basis

EPS of $2.81, up 12% excluding the reserve

Operating cash flow of $338 million, up 35%

Full-year sales forecast puts growth at 11-12%

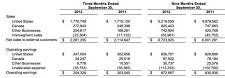

Grainger reported sales increased 8% to $2.3 billion in the third quarter of 2012, with sales on a daily basis gaining 10%, including 3 percentage points from acquisitions and a 1 percentage point decline attributable to unfavorable foreign exchange.

Daily organic sales for the quarter increased 8% — 4 percentage points from volume and 4 percentage points from price.

Third-quarter operating earnings fell 16% to $254 million, dragged down by a $70 million pre-tax reserve recorded in the period for a settlement in principle to resolve pricing disclosure issues relating to government contracts with General Services Administration (GSA) and United States Postal Service (USPS). The proposed settlement, which covers 12 years of sales to the GSA and 10 years of sales to the USPS, remains subject to the approval of the U.S. Department of Justice (DOJ). In addition, the company has established a $6 million pre-tax reserve for resolving tax, freight and miscellaneous billing issues with these government customers.

Excluding the reserve, net earnings increased 11% and earnings per share of $2.81 increased 12%. Including the reserve, reported net earnings for the third quarter decreased 15% to $155 million and earnings per share of $2.15 decreased 14% versus $2.51 in 2011.

“We delivered a solid quarter, with stronger organic sales growth in September than in August and continued to gain market share, expand margins and generate nearly $100 million in operating cash flow over the prior year,” stated CEO Jim Ryan.

Third-quarter sales in the U.S. grew 4% to $1.77 billion, driven primarily by price gains. Solid sales growth and market share gains in the heavy manufacturing, light manufacturing, commercial, government and retail end markets contributed to the sales performance for the quarter.

U.S. operating earnings fell 18% in Q3 to $247 million.

Nine-month sales in the U.S. gained 7% to $5.22 billion, while operating earnings rose 3.2% to $856.7 million.

Q3 sales in Canada grew 10% to $272.9 million, led by strong led by strong growth to customers in the commercial services, oil and gas, forestry, contractor and utilities end markets. Operating earnings in Canada grew 29% to $34.2 million.

Nine-month Canadian revenue increased 10% to $825.4 million, with operating earnings up 25% to $97.5 million.

Overall nine-month sales grew 12% to $6.7 billion, with net earnings up 5% to $534 million. ©2012 GlobalFastenerNews

Related Stories:

• Fastenal Doubles Vending Machine Installs Amid Strong Growth

• Price Gains Drive Grainger Growth in October

• MW Industries Expanding Springmasters / B&S Screw Machine Division

Related Links:

• Grainger

Share: