6/10/2013 1:01:00 AM

NEWS BRIEF

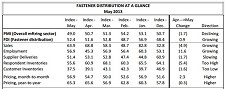

The BB&T Capital Markets Fastener Distributor Index (FDI) edged up to 52.4 in May, up from the 51.6 reported in April.

“The FDI seems to have settled into a groove: while May was technically a step up from April (51.6), over the last three months the reading has been stable in the low 50s, suggesting sluggish-but-positive growth.”

Sales in May were lower but in expansion territory (63.8, vs. 68.8 in Apr.) and the employment picture improved (56.9, vs. 45.3 in April). However, customer inventories declined (37.5, vs. 39.1 in April).

“Substantively, May feels similar to March and April: most are seeing growth, but not a lot, and the most hopeful sign is that at some point, presumably, there will be a need to add some inventory into the same channel.”

The FDI outlook?

“Tempered, but still positive.”

“In May, the ratio of respondents that were optimistic was largely unchanged (47.2%, vs. 46.9% in April). Pessimism edged up a bit, as those expecting a weaker environment in six months were 16.7% (vs. 12.5% in Apr.). The May outlook is more of the same: a favorable ratio of “higher” to “lower” outlooks suggests that fear of a slowing or downturn is very low.”

Pricing is starting to look “a bit positive.”

“Sequential pricing improved for the third straight month (56.9, vs. 54.8 in April). Most respondents still have higher annual pricing (65.3, vs. 65.6 in Apr.). The magnitude of the annual price increases cited was in the 1%-2% range, actually up from what had been 0%-1% for many months.

“This suggests some firms are slipping in, and realizing, price increases.”

The FDI is a monthly survey of North American fastener distributors. As a diffusion index, readings above 50 signal strength and below 50 signal weakness.

The FDI is a joint production of BB&T Capital Markets and the FCH Sourcing Network, the online network for industrial fasteners. ©2013 GlobalFastenerNews.com

Related Stories:

• Hagan: Fastener Company Acquisitions Remain Strong in 2012

Share: