1/27/2014 11:11:00 AM

NEWS BRIEFS

Grainger Posts Record Sales On U.S. Market Strength

![]()

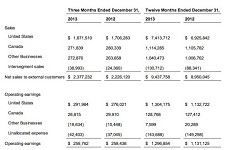

Grainger reported sales, including fasteners, grew 5% to a record $9.4 billion in 2013. Net earnings increased 16% to $797 million and earnings per share gained 17% to $11.13.

“We made significant investments aimed directly at increasing our scale and accelerating share gains in the large and highly fragmented MRO market,” stated CEO Jim Ryan. “Going forward, we will continue to invest in areas such as eCommerce, sales force expansion, inventory management solutions and distribution centers in order to drive market share growth and deliver solid returns.”

Full-year results included a 7% gain in fourth-quarter sales to $2.4 billion, flat net earnings of $157 million, and a 1% EPS gain to $2.20.

United States

Sales in the U.S. segment increased 10% in Q4, driven by 5 percentage points from volume, 6 percentage points from sales from the E&R Industrial, Techni-Tool and Safety Solutions acquisitions and 1 percentage point from sales of seasonal products, partially offset by a 1 percentage point decline from price and 1 percentage point from unfavorable comparison to sales related to Hurricane Sandy in 2012. “Strong sales growth to customers in the manufacturing, retail, natural resources and commercial customer end markets” contributed to the increase.

U.S. operating earnings rose 6%, driven by the 10 percent sales growth and positive expense leverage, partially offset by lower gross profit margins.

Canada

Q4 sales at Acklands-Grainger decreased 3%, consisting of 3 percentage points increase from volume offset by a 6 percentage points decline from unfavorable foreign exchange. Operating earnings in Canada fell 10%, driven by lower gross profit margins, unfavorable foreign exchange and negative expense leverage.

Other Businesses

Sales for the Other Businesses, which includes operations primarily in Asia, Europe and Latin America, increased 3% in Q4. This performance consisted of 11 percentage points of growth from volume and price, partially offset by an 8 percentage point decline from unfavorable foreign exchange. “Sales growth in the Other Businesses was driven by Zoro Tools and the business in Mexico. Strong sales growth in Japan was offset by the weakness in the Japanese yen versus the U.S. dollar.” The Other Businesses segment posted a $20 million operating loss in Q4.

During 2013 Grainger invested an incremental $132 million to drive growth and scale, primarily in the U.S., and achieved the following results:

eCommerce: Grainger surpassed $3 billion in eCommerce sales in 2013, representing 33 percent of total company sales. eCommerce represents the fastest growing and most profitable channel in the business. The company also transitioned to a new web platform, launched a Spanish website and introduced innovative mobile solutions.

Sales Force Expansion: In the U.S., Grainger added 180 new sales representatives in 2013. Since 2009, Grainger has added 930 new U.S. sales representatives who, in aggregate, contributed approximately 1 percentage point of company sales growth in 2013.

Inventory Management: Total U.S. KeepStock installations, including vendor managed inventory, customer managed inventory and vending machines, grew 38%, ending the year at approximately 55,000 installations.

Product Line Expansion: In the Grainger U.S. business, Grainger.com added more than 300,000 new products, bringing the total number of products to more than 1.2 million products online. In Canada, Acklands-Grainger announced the addition of 200,000 products to its online offering.

Distribution Network: Grainger enhanced its North America distribution center network by opening a 1 million sq ft highly automated distribution center in Illinois that serves as the company’s new central stocking facility. Grainger also began construction on a 500,000 sq ft distribution center in the Toronto area.

Single Channel Online Model: MonotaRO, the online business in Japan, grew nearly 20% in local currency in 2013 and was named to the Forbes® Asia “Best Under A Billion” list.

Related Stories:

• U.S. Industrial Fastener Demand to Rise Through 2017

• U.S. Fastener Exports Outpace Imports

• Fastener Manufacturer Philidas to Shut Down

Related Links:

• Grainger

Share: