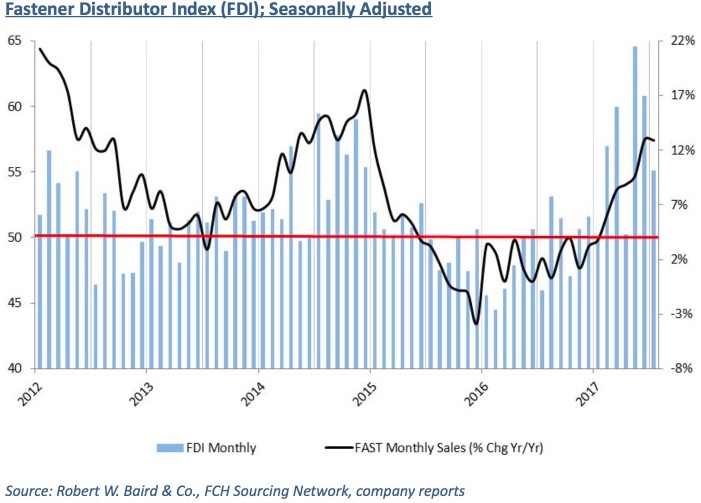

The seasonally-adjusted July FDI (55.1) ticked down from June’s strong 60.8 reading, “mainly driven by a slight moderation in sales momentum relative to a record June,” writes R.W. Baird analyst David Manthey.

In the July survey, 47% of respondents indicated sales were “better” relative to seasonal expectations, down slightly vs. June (64%). Relative to historical seasonal readings in the month of July, this month’s seasonally-adjusted sales index of 69.8 suggests selling conditions still remain very strong overall.

“Encouragingly, pricing was higher on a y/y basis for a majority of respondents (53%) – driving the FDI y/y pricing index to the highest level since August 2014. As it relates to customer inventory levels, most respondents believe inventories are relatively in line with expectations (70% of responses), while 30% indicated inventory levels are too low.”

The FDI Forward-Looking Indicator clicked down slightly to 62.9 vs. 64 in June. The Forward- Looking Indicator averaged 49.7 during 2016, but has averaged 61 so far in 2017.

The FDI found manufacturing employment remains stable. “Following a notably more bullish turn in hiring sentiment in May, respondents have indicated relatively stable hiring conditions for two straight months,” Manthey writes.

Roughly 73% of distributors indicated hiring levels were unchanged relative to seasonal expectations, while 17% saw hiring pick up (vs. 21% in April, 47% in May, and 36% in June).

Commentary on current market conditions was mixed. Some noted continued strong trends, while others are seeing a possible leveling o of activity levels a er several strong months (although nevertheless s ll solidly higher y/y).

As one distributor put it, “The last couple of months things have evened out… not the huge growth of the first several months, but absolutely higher sales than last year.”

The outlook for the remainder of the year remains largely positive, as 57% of respondents expect higher activity levels over the next six months vs. today, while 3% expect lower.

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association. Web: fdisurvey.com

Share: