NEWS BRIEFS

Report: Boeing Still Struggling With 787 Fastener Supply Chain

A new report claims Boeing continues to be concerned about the procurement of bolts, rivets and nutplates for its 787 Dreamliner program, even as successful test flights build anticipation for order deliveries.

“Boeing: The Fight for Fasteners,” authored by the William Davidson Institute at the University of Michigan, details efforts by Boeing executives to streamline the fastener supply chain more than 18 months after miscalculating lead times for critical aerospace fasteners.

“Engineers at Boeing never could have imagined that fasteners, which comprise approximately 3% of the total cost of an aircraft, would become such an issue,” writes report author Moses Lee.

As the fastener shortage began to delay production of the 787 test aircraft, Boeing reportedly turned to John Byrne, director of supplier management common commodities, and Valerie Feliberti, senior manager for structural standards, to fix the problem.

“To ensure that Boeing had enough fasteners to meet future production goals for the fastest-selling aircraft in history, we knew that we had to fundamentally change the structure of the industry’s supply chain,” Byrne is quoted in the report.

Byrne and Feliberti are still tweaking a fastener procurement system that eliminates widely-varying pricing structures among suppliers while providing fastener manufacturers a more accurate demand assessment.

Supply Chain Complexity, Consolidation Hampered 787 Program

Prior to September 11, 2001, the fastener industry had six primary manufacturers. But after global demand for air travel plummeted, three primary fastener manufacturers remained: Alcoa Fastening System (AFS), Precision Castparts Corp. (PCC), and Lisi Aerospace.

Approximately

80% of fasteners used to produce Boeing airplanes came from these three manufacturers.

“During this industry consolidation, manufacturers significantly reduced capacity and their workforce,” the report states. “Consequently, many plants were idled or permanently closed.”

The complexity of the fastener supply chain surprised Boeing.

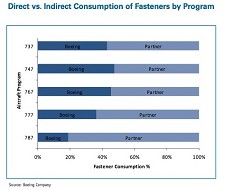

“Original equipment manufacturer (OEM) aircraft builders generally sourced fasteners directly from fastener manufacturers or through third party aerospace distributors, such as Wesco, B/E Aerospace, or Anixter,” the report states. “Tier-1 partners procured from a number of sources, such as fastener manufacturers, aerospace distributors, and brokerage houses.”

The shift in de-centralized procurement control on the 787 “started to exacerbate an already complicated fastener supply chain.”

Another wrinkle emerged in Boeing’s plan: the 787’s composite material “required many new types of fasteners with a different coating and a higher proportion of titanium.”

To produce these new fasteners, manufacturers needed to change over their plants and source a greater amount of titanium, according to the report.

“As a result of this, under the 787 program, both fastener spend and operational risk increased dramatically,” said Byrne.

“Boeing: The Fight for Fasteners” is available for $6 at globalens.com. ©2010 GlobalFastenerNews.com

Related Stories:

• Top 10 Fastener Stories of 2009

• Bolts Fixed, Northrup Grumman Delivers $2.3b Navy Submarine

• Sonic Industries Part of Boeing Team on Aerial Refueling Tankers

Related Links:

Share: