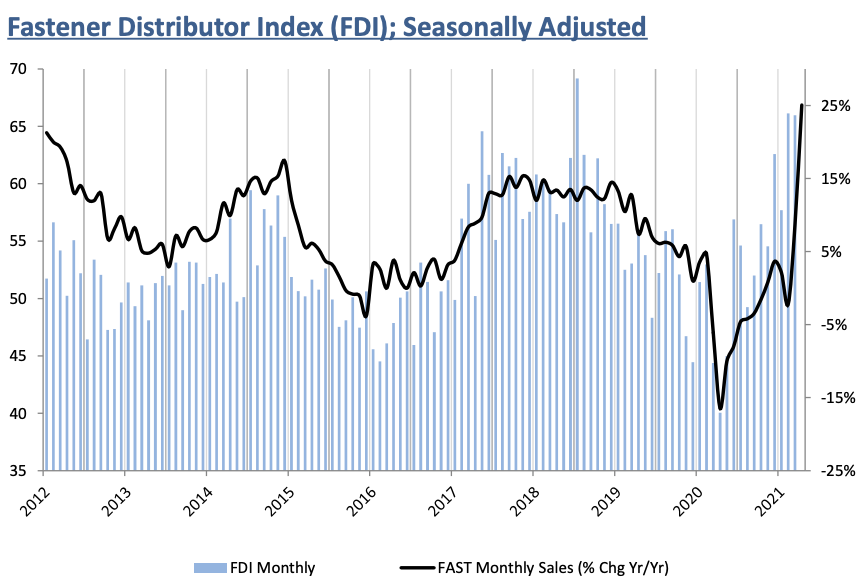

The April seasonally adjusted Fastener Distributor Index (FDI) 58.7 showed market conditions cooled off from the frenetic pace seen in February and March as supply chain constraints inhibited growth. While falling from March’s 66 pace, the FDI indicates continued growth in fastener markets, according to R.W. Baird analyst David Manthey.

About half of respondents saw better than seasonally expected sales, which was significantly lower than the 91% in March and the less than 70% December through February.

“We attribute this to continued shipping delays/container shortages and an inability to source products, which has resulted in many respondents being unable to fulfill all customer orders,” Manthey writes.

These dynamics have also translated into continued price increases, with 94% of respondents seeing higher point-of-sale pricing year to and 72% higher month to month.

The seasonally adjusted Forward Looking Index declined to 76.7 in April.

The main driver of the contraction was the six-month outlook, which was slightly less optimistic than prior months, according to Manthey.

“We believe sentiment is being more directly impacted by supply chain constraints than in prior months when respondents were still navigating these challenges reasonably well. That said, we see a positive outlook for the FDI ahead as customer inventories remain at very low levels, and note an FLI well into the 70’s is consistent with expectations for continued improvement in fastener markets ahead.”

Even if respondents can’t meet demand, distributors seem to be able to meet enough demand to generate good levels of sales growth.

Employment levels remain stable. The FDI employment index came in at 66.7, the third consecutive month in the 66-67 range. Just over 40% of respondents saw employment levels as above seasonal expectations in April – essentially equal to March’s 41%/February’s 43%.

While port backup, container shortages, and increasing freight rates have been consistent topics of discussion in the FDI the last several months, respondents seemed to be feeling the impacts more directly on their businesses this month.

“We are finally noticing the container shortage and backup at the ports,” said one respondent. “We assume it is only going to get worse until 2022.”

Another commented: “Inventories at all of the Major Master Importers (IE. BBI, Stelfast, XL Screw, Star Stainless, Vertex etc. ) are very low….we are getting parts that we need from all of their branches from all over the country. Margins are going down because of the additional ‘freight in’ charges. We are feeling the pain of all of those ships that are backed in the ports of LA, SanDiego, Seattle etc. ”

Several respondents indicated the supply chain is holding back their ability to meet otherwise robust demand.

“Stressed supply chain is depressing sales. If our customers could obtain all components they need, they would be building more. Transit markets and material shortage will continue to apply upward pressure on pricing.”

The FDI is a monthly survey of North American fastener distributors conducted by the FCH Sourcing Network, the National Fastener Distributors Association and Baird. Web: fdisurvey.com

Share: