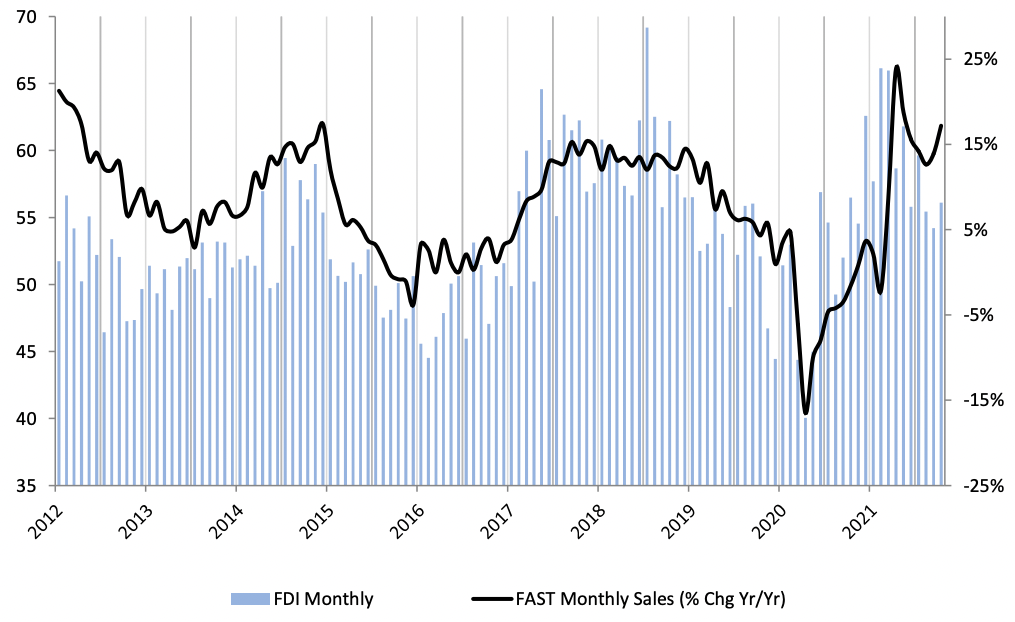

The seasonally adjusted October Fastener Distributor Index (56.1) improved over September (54.2) amid “better selling momentum and higher employment levels,” according to R.W. Baird analyst David Manthey.

Pricing picked up modestly as the proportion of respondents reporting higher pricing was 73% compared to 71% the previous month.

The Forward Looking Index settled at 64.5, contracting for the second consecutive month.

“This was attributable to a slight uptick in both customer and respondent inventory levels (bearish for potential future restocking/demand), although inventory levels remain very low in absolute terms, particularly at the customer level,” Manthey writes.

The six-month outlook was essentially unchanged, with 42% of respondents expecting activity levels to be higher six months from now.

“That said, product shortages in the face of continued strong demand could simply lengthen out the cycle, implying the FDI could remain in growth mode for much longer.”

The FDI employment index rose to 65.4 vs. 54.8 in September, suggesting some loosening in the very tight labor market. Fewer respondents indicated employment levels were below seasonal expectations (September 26% vs. October just 6%). Reflecting this, one participant said,

“On the employee side we are finding more people coming in to apply for open positions vs September and before,” one respondent noted.

Respondents largely did not see a material improvement in the state of the supply chain in October. Said one respondent,

“Deliveries not improving,” noted one respondent. “Distributors all searching for the same parts, vanishing inventory levels. No end in sight!”

Another respondent commented: “Slow supply chain is a real challenge in purchases & receiving goods import & domestic made.” One respondent indicated some easing in inventory held in transit but remained wary of potential upcoming transportation issues around the holidays.

“Inventory that has been lost in transit purgatory has finally begun to show up. Attention must be paid to demand trends and managing inventories moving forward, with the challenges mainly pertaining to continued shipping congestion through the holiday and CNY season.”

Demand commentary, however, remains positive: “Sales are incredible. Up almost 40% YTD over last year and almost 30% from 2019.”

The FDI is a monthly survey of North American fastener distributors conducted by the FCH Sourcing Network, the National Fastener Distributors Association and Baird. Web: fdisurvey.com

Share: