7/19/2010

HEADLINES

PERSPECTIVE – Fastener Editors: 2009 Sales Down, 2010 Improving

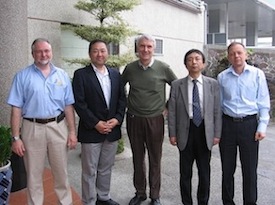

(Left to right) Phil Matten, editor of the European-based Fastener + Fixing Magazine; Onaya Yoshiteru, president of Fastening Journal Co. Ltd. of Japan; John Wolz, editor of U.S.-based GlobalFastenerNews.com; Mamoru Kashiwagi, executive director of the industrial fasteners edition of Metal Industry News of Japan; and Alexander Ostashov, editor of “Fasteners, Adhesives, Tool &” magazine of Russia.

It was unanimous among fastener journalists touring Taiwan: Fastener sales plummeted in 2009, but distributors and manufacturers are reporting numbers are up thus far for 2010.

Onaya Yoshiteru, president of Fastening Journal Co. Ltd. of Japan, reported multiple manufacturers 2009 sales were down as much as 50%. The worst case he knows of involved a company whose sales fell 90%.

Construction fasteners were down 60%.

“Since 2009 we have started to recover,” and sales are back up to 80% of previous levels, Yoshiteru added.

Rather than sales, Japanese manufacturers are now concerned about how to raise prices, Yoshiteru said.

Just before the recession, optimism prevailed because month after month sales were running 20% over previous year.

“It is the same set of problems for Europe,” Phil Matten, editor of the European-based Fastener + Fixing Magazine said of the 2009 sales plunge and 2010 price increases.

The European automotive market fell 40%, truck market was down 60% and construction 30% to 35%.

Niches are coming back first, such as the small backhoe as house building recovers.

“Automotive stopped ordering, period,” Matten explained.

Russia’s “Fasteners, Adhesives, Tools &” magazine editor Alexander Ostashov said the Russian government is still looking at protective tariffs, but the overall situation is “pushing the Russian manufacturers of fasteners to upgrade the range and quality of products.”

Ostashov cited the example of Bolt.Ru, which has finished conducting certification tests of high-strength bolts, strength class 10,9, for the German company, Peiner Umformtechnik GmbH. Now these bolts can be used in bridge construction in Russia.

In order to expand the range of fasteners produced in Russia, a “lot of work should be executed. So now the factories, producing fasteners, are intensifying their actions,” Ostashov said.

Since last year the largest Russian producer of automobile fasteners – BelZAN – began to produce fasteners for road construction and plans fasteners for the power facilities. The Severstal-Metiz group of companies received certification for high-strength fasteners for bridge construction.

“Many factories are planning to expand their machine shops,” Ostashov added.

Corrections of Russian standards for high-strength fasteners and preparing standards for special fasteners for bridge structures are being finalized.

GlobalFastenerNews.com editor John Wolz finds North American manufacturers and distributors are reporting sales are up, but confidence in sustained sales is still lagging.

“Sales,” “sales” and “sales” were the most frequently mentioned problems in the End of 2009 FIN Survey, Wolz noted.

Nearly 80% of distributors and manufacturers reported sales fell for 2009. The FIN Sales Index fell to its lowest level.

The FIN Company Performance Index also dropped to its lowest point in the 16 years industry leaders have been asked to rate their company performance. It decreased to 3.8 at the end of 2009, compared with 6.5 a year before.

Toward the end of 2009, the FIN Fastener Stock Index regained most of the value it had lost in the stock plunge of 2008.

Mamoru Kashiwagi, executive director of the industrial fasteners edition of Metal Industry News of Japan, observed that the recession has led to assets being sold to bigger companies. “Big companies are getting bigger.”

Europe has a combination of multi-national companies and “still a lot of family-owned companies,” Matten noted. He cited ABC, Fontana, Agrati and Philose as examples of European fastener family companies, which date back for hundreds of years.

Almost all fastener producers are facing “pressure to manufacture in low cost locations,” Matten said. There are certain exceptions such as “safety critical” fasteners.

Decades ago Japan found it couldn’t compete with China on standard fasteners and they turned to value-added products.

Editor’s Note: As part of the Taiwan External Trade Development Council’s promotions for the new fastener trade show in October, five fastener journalists from Russia, Japan, the UK and U.S. toured seven Kaohsiung-area fastener plants. ©2010 GlobalFastenerNews.com

Share: