FIN SURVEY

![]()

Three-quarters of fastener companies participating in the FIN Survey claimed “Moderate” to “Strong” increases in sales and profit during 2010. Those results follow a difficult 2009, when less than one in ten fastener firms reported sales growth.

size: small;”>A 51% majority of distributors and manufacturers achieved moderate sales growth in 2010, while an additional 21% reported strong sales increases.

Just over 18% of fastener companies said sales were stagnant in 2010, with an additional 2% claiming sales fell during the year.

The fastener industry also saw its bottom line improved in 2010, with 75% of FIN Survey participants reporting moderate to strong profit gains.

Half of all fastener companies claimed moderate improvement in profit, with an additional 25% achieving strong net earnings growth and 19% saw their bottom line stabilize.

The big picture looks even brighter in 2011, with 82% of fastener companies predicting sales growth. About 65% of companies estimate the growth with be “moderate,” while 17% forecast “strong” revenue growth. Just under two in ten FIN Survey participants expect sales to flatline in 2011.

Profits are expected to rise as well in the coming year, with 62% of companies anticipating “moderate” profit improvement and 10% eyeing a “strong” increase in net earnings.

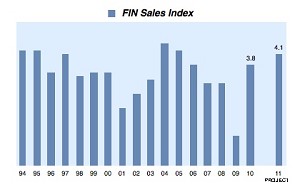

In 2010 the FIN Sales Index more than doubled to 3.8 from the previous year’s 1.84 – the lowest level since FIN began tracking fastener industry sales in 1994.

At 3.6 the FIN Profit Index rebounded from 2009’s record low 2.14.

This year the sales index forecasts moderate growth to 4.1 and the profit index forecasted to gain more than 11% to 4. ©2011 GlobalFastenerNews.com

Related Stories:

• Innovative Fastener Handles Shock, Heat, and Vibration of Oil Industry Drilling Equipment

• Grainger Sales Outside U.S. Are Soaring

• Loose Shuttle Payload Fasteners Puzzle NASA Engineers

• Report: Global Steel Wire Market to Reach US$25.4 Billion by 2015

Share: