2/19/2013 2:22:00 AM

NEWS BRIEF

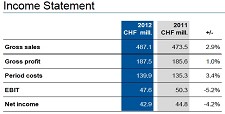

Despite a generally difficult business environment, the Bossard Group earned the third best result in the company’s history. Consolidated net income decreased slightly by CHF 1.9 million to CHF 42.9 million. The operating profit was CHF 47.6 million (-5.2%).

On this earnings level, the Bossard Group achieved a double digit EBIT margin of 10.1% for the third year in a row, a “significantly higher” than the average for the industry.

“Although there was definitely a lack of momentum last year, the Bossard Group nevertheless earned a good result,” says CEO David Dean. “I feel positive about the fact that we gained new customers in fiscal 2012 and were able to expand our product line.”

Once again, Bossard has increased sales over the previous year. Earnings rose 2.9%

to CHF 487.1 million, primarily due to positive business developments in the U.S. Bossard increased sales in America by 10.6% in local currency; converted to Swiss Francs, this was an increase of as much as 17%.

“America thus experienced double-digit sales growth for the third year in a row. This proof of excellent performance is attributable to brisk demand from our existing customer base as well as increased business from new customers.”

Excluding the acquisition of KVT-Fastening and the divestment of Bossard Metrics Inc., USA, purely organic growth was 2.1% in Swiss Francs and 0.8% in local currency.

In Europe, all regional companies were affected by the sluggish demand.

In spite of that, we were able to keep the sales slump (-0.7 percent in local currency) within bounds by acquiring new customers.

Business in Asia was also down slightly (-2.6 percent in local currency).

“Once again our export-oriented Asian customers suffered from weak foreign demand in 2012.”

Sales to customers in the wind and solar sectors as well as the semiconductor industry showed unsatisfactory development.

However, profitability remains high, Bossard said. The operating profit (EBIT) margin of 10.1% remained well above the average for the industry.

“The slight decrease in the EBIT margin is largely attributable to sales developments and the associated margin mix.”

While the operating margin increased in Europe and the Americas, it fell below the prior year’s level in Asia.

The return on sales dropped from 9.8% last year to 9.1% in 2012.

“This decline can be explained by a variety of factors: While the higher sales volume increased profits, we also shouldered financial burdens in fiscal 2012. Thus, labor costs increased over the prior year’s level, and tax expenditures also rose.

In net terms, the consolidated net income amounted to CHF 42.9 million, compared to CHF 44.8 million last year.

Click here for Bossard’s full report. ©2013 GlobalFastenerNews.com

Related Stories:

• EU Dropping Stainless Circumvention Case Against Thailand & Malaysia

• Bossard North America Wins Supplier Award

• ACQUISITION: Bossard To Acquire Electrical Products Supplier Intrado

• Report: US Adhesives Demand To Rise 2.2% Annually

Related Links:

Share: