3/23/2015 2:35:00 AM

NEWS BRIEFS

Chicago Rivet Reports 5 Years of Fastener Growth

![]()

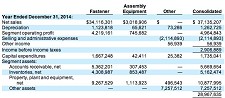

Chicago Rivet & Machine Co. reported fastener segment sales grew 1.5% to $34.1 million in 2014, marking the fifth consecutive year of fastener segment growth.

“Our fastener segment, which relies on the automotive sector for the majority of its revenues, benefited from strong automobile sales in 2014,” the company stated. Although sales increased, fastener segment margins declined in 2014 due to a $267,000 increase in tooling expenses due to new parts production. “Significant” investments in production equipment increased depreciation $165,000 compared to 2013, while health insurance premiums rose $138,000.

“Certain operating expenses were reduced during the year, but only partially offset the larger increases, resulting in a net reduction in gross margin for the fastener segment of $354,414 in 2014.”

Assembly equipment segment revenues declined 13.8% to $3.01 million in 2014.

“A decline in the number of machines shipped, as well as the inclusion of a certain high-value order shipped during the fourth quarter of 2013, accounted for the decline in the assembly equipment segment sales.”

However, machine parts and tooling sales increased in 2014.

While operating expenses in the assembly equipment segment were steady, lower sales resulted in a reduction in assembly equipment segment gross margins of $219,136.

Selling and administrative expenses edged up less than 1% to $5.44 million, primarily due to 1 $75,402 increase in commissions and payroll, and health insurance increases of $54,705. Partially offsetting these increases was a reduction in profit sharing expense of $77,767, related to reduced operating results. As a percentage of net sales, selling and administrative expenses were 14.6% in 2014 compared to 14.5% in 2013.

Overall Chicago Rivet sales in 2014 increased slightly to $37.1 million.

“The first half of 2014 continued to build on the strong sales growth we have reported since the end of the recession in 2009, as net sales for the first six months of theyear increased 5.4% over the first half of 2013. This growth in sales contributed to an increase in net income for the first half of the year, even though certain expenses had increased. “Sales growth stalled in the second half of the year compared to the particularly strong results in the second half of 2013, with both operating segments recording declines.”

Overall, net sales in the third and fourth quarters reflected a decline of 5.3% compared to the same period a year earlier.

“While sales in 2014 were fractionally higher than a year earlier, net income declined to $1,951,889, or $2.02 per share, in 2014 from $2,479,029, or $2.57 per share, in 2013.” Increases in tooling, depreciation and health insurance expense as well as a reduction in gains from equipment disposals and a less favorable product mix compared to 2013, all contributed to the reduction in net income.

The company’s effective income tax rates were 32.9% in 2014 and 31.6% in 2013.

Total capital expenditures were cut in half to $1.74 million. Fastener segment additions accounted for $1.67 million of the total, including $801,139 for cold heading and screw machine equipment and $201,901 for secondary processing equipment. Inspection equipment comprised $325,133 of the fastener segment additions, while the remaining additions of $339,075 were for various general plant equipment and facilities improvements.

Assembly equipment segment additions in 2014 were $42,411 for production equipment. Investments for the benefit of both operating segments, primarily for building improvements, totaled $25,382 during 2014.

Working capital increased 2.5% to $16 million, boosted by a $300,000 increase in inventory and a $200,000 increase in prepaid income taxes.

At December 31, 2014, the Company employed 236 people.

“The overall economy in 2015 is widely expected to improve over 2014,” the company stated. “North American car and truck production increased approximately 6% during 2014, to its third largest year ever.

“Now that production has returned to pre-recession levels, growth is expected to be closer to the rate of the overall economy. An improving job market, low interest rates and the recent drop in gasoline prices are underpinnings that support growth in consumer spending, which is favorable to our fastener segment, as the majority of that segment’s revenue comes from the automotive sector.”

The outlook for our assembly equipment segment, which has had a more uneven recovery, remains more difficult to forecast.

“Our profitable results in recent years have allowed us to make significant investments in our operations, which have provided additional capacity and production capabilities.”

Chicago Rivet management forecasts continued “significant” investments in equipment and our facilities.

“This includes a planned expansion of our Madison Heights fastener plant in order to increase capacity and improve production efficiency.”

Related Stories:

• Brighton-Best Acquiring EZ Sockets

• Anixter Fasteners Testing New Name

• U.S. Fastener Exports & Imports Grow in January

• Fastener Stocks Continue to Struggle

Related Links:

Share: