6/6/2016 2:27:00 PM

NEWS BRIEFS

FDI: Early Momentum Continues in May

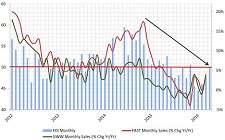

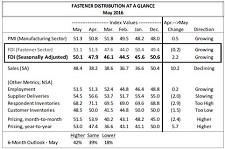

May’s seasonally adjusted FDI reading (50.1) proved modestly higher for the third consecutive month, entering expansion territory (above 50) for the first time this year, according to the BB&TCM Fastener Distributor Index.

“May results benefitted from a slight uptick in sales bias among respondents, while yr/yr pricing ticked positive for the first time since December (consistent with the early movement in CPI and higher raw material pricing).”

Roughly 66% of May participants noted similar or better sequential sales growth, compared to 64% in April.

Regarding customer inventories, 15% of participants viewed current levels as “too high.”

The May sequential point-of-sale pricing index “remained in expansion territory (51.5) after jumping above 50 in April for the first time since June 2015.”

On an annual basis, the pricing index reached similar levels this month (53.0) for the first time since December 2014. According to participant commentary, higher material costs, including inflated steel pricing (HRC steel futures +8% in May), could portend continued pricing growth near-term (Bloomberg).

“We believe the overall environment for pricing remains notably soft given minimal inflation, although the April CPI expansion (+50 bps sequentially) was a modest positive.”

However, labor remains stagnant, the FDI found. Employment (51.5) was largely unchanged for May, as 91% of participants noted unchanged or reduced hiring versus the preceding month.

“We also note the outlook for survey respondents remains uncertain, with 58% still expecting unchanged or declining conditions in six months.”

The FDI is a monthly survey of NorAm fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association.

Related Stories:

Share: