5/2/2016 2:29:00 AM

HEADLINES

Fastener Prices Rising Based on Jump in Cost of China’s Steel

Steel prices in China hit a 25-year low in late 2015, but thus far in 2016 prices have jumped and the increases are beginning to show in fastener prices.

Multiple executives are reporting fastener prices have begun rising, but at a slower rate than China’s steel.

For example, steel rebar on the Shanghai Futures Exchange, has jumped 54% since the beginning of 2016.

• Jun Xu of Brighton-Best International finds fastener costs have risen in from 10% to 30% – below the 50% to 60% that steel has jumped thus far this year.

Xu explained that the 10% to 30% fastener price range increase “is dictated by the complexity of the product (% conversion versus raw material costs), and the capital strength of the factory – larger factories can inventory more steel and lock in longer term contracts versus smaller players.

• Tom Bigott, purchasing manager for XL Screw, explained that the steel price increases can be attributed to the China government previously “financially supporting steel mills to maintain production during a prolonged period of decreasing international and domestic demand,” Bigott said. “The result was an excess supply that fueled further steel price reductions.”

But in February 2016, “the China government reversed its policy and informed all steel mills to become profitable or face a forced shutdown,” Bigott explained.

“Not wanting to be selected to close, steel mills began to raise prices. This created an immediate shortage of supply, as fastener manufacturers rushed to increase wire rod purchases to avoid further price increases.

“Steel mills were not prepared for the sudden increase in demand, did not have ample inventory on hand and began to short ship wire rod,” Bigott said.

As steel prices rose dramatically there was “an immediate impact of fastener purchase prices,” Bigott pointed out. “China fastener manufacturers have reduced validity on price quotes and increased lead time on orders.

“This dramatic increase in both steel and fastener prices is expected by many fastener manufacturers to maintain, as the China government has reversed its prior export policy and is now mandating China steel price match international price levels.”

• “After several years of declining steel costs, prices have risen substantially over the past several months, with the largest increase occurring in April,” Mike Wrenn of Lindstrom observed. “Raw material costs are now above year ago levels.”

“The impact on fastener prices has been relatively small,” he added. However, Wrenn noted that a “a few factories have delayed quotes” and if steel prices stay at “current levels or higher, fastener costs will increase,” he warned.

• In contrast to the prices of steel in China, the stainless fastener market prices are lower due to the price of nickel being down.

Bruce Wheeler of Star Stainless noted that nickel, a traded commodity on the London Metal Exchange, has been trading this year at a relatively low price level in comparison to recent years.

Nickel inventories grew during 2014 and 2015, making the worldwide supply became out of balance with demand.

There was some uptick in nickel prices since February this year, but Wheeler termed it as “rather minimal and almost not worth losing any sleep over at this time.”

“These days the world of commodities have become rather reactionary to good or bad news and history shows us things can change at the drop of the hat,” Wheeler observed.

Even with the small uptick over the last three months, stainless fastener prices “still remain low, creating a good buying opportunity,” Wheeler said.

“Although it’s a good time to buy, the current market has a reverse impact on the wire mills, screw producers and importers as the lower price point decreases overall sales revenues,” Wheeler pointed out.

Noting that two thirds of the worlds nickel goes into producing stainless steel “and once the world’s supply of nickel comes in balance with anticipated demand then prices will rise once again, Wheeler advised.

Global insurer Coface offered a grim outlook on the steel sector: “The market is not expected to regain equilibrium before 2018.”

Coface predicted, “While global production is weakening (down 3.1% at end-February) and one-third of steel production lines are at a standstill, supply is still abundant.”

Some analysts believe that the supply and demand imbalance are improving, other observers blame speculation for the China steel price increases.

Coface is watching to see if the Chinese government will succeed in reforms to reduce steel overcapacity.

Xu concluded that Brighton-Best expects “this cost pressure to have upward pressure on pricing in the market.”

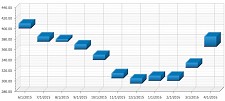

Globally, steel wire rod prices in the last year have ranged from $305 to $410, with an average of $350.45.

In Europe, Beyond Steel: Anti-Dumping?

In Europe the China steel pricing followed the repeal of the anti dumping duties and there is uncertainty about when or if European manufacturers will file a new anti dumping complaint with the European Commission.

One European industry observer said importers are now “cautious about switching orders to China.”

Taiwanese and Vietnamese suppliers “are inevitably doing everything they can to retain the European business,” and factories will be producing from wire stocks at relatively low prices. Taiwan has its own supply, but Vietnam’s wire can come from China. Chinese factories don’t tend generally to buy wire stocks beyond immediate requirements so are more immediately affected by price movement.

A question in China is how much additional capacity is coming back on stream and increasing supply. Various sources estimate between 40 and 60 closed blast furnaces in China have been restarted as prices have risen – exacerbating Chinese overcapacity.

The iron ore and steel futures markets in China “have eased a little” following recent increases. Fastener factories are reportedly only buying what they need – waiting to see if steel prices will fall before ordering significant stocks.”

European importers say Chinese exporters are only offering short validity on quotations.

Related Stories:

• ASTM F16 Honors Smith With Top Award

Share: