4/29/2014 1:57:00 PM

NEWS BRIEFS

Fasteners Lead The Way To Improved Performance at Anixter

![]()

Anixter International reported OEM Supply sales – primarily fasteners – rose 9.4% to $249.5 million in the opening quarter of 2014, “reflecting the continued increase in customer production levels combined with incremental business wins.”

“For the fifth consecutive quarter we achieved significant performance improvements in our Fasteners segment, reflecting increases in our customers’ production levels coupled with the results of actions we took to reposition the business for profitable growth,” stated CEO Bob Eck.

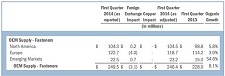

Excluding the $3.1 million favorable impact from foreign exchange, organic fastener sales increased 8.1% year-over-year. Sequentially, sales increased 0.7%.

Fastener sales in North America achieved 5.8% organic growth to $104.3 million, while fastener sales in Europe grew 3.9% organically to $122.7 million. Fastener revenue in Emerging Markets jumped 54.6% to $22.5 million.

“We disclosed in our previous call that (fastener) sales would be negatively impacted by approximately $10 million per quarter by one of our customers’ decisions to dual source,” Eck commented in a conference call transcribed by SeekingAlpha. “Excluding this impact, our Fasteners growth would have delivered a very strong 14% growth rate.”

Eck said fastener gains in North America were driven by a “fairly broad improvement” in customer demand, including steadily increasing production from heavy truck customers. Other sectors of growth include agricultural and recreational equipment customers.

“We have the benefit of having some customers who are market leaders in the markets they participate in, and they benefit first from increasing spend in their sort of segment,” Eck stated.

Fastener segment operating income more than doubled to $12.8 million. Operating margin of 5.1% compares to operating margin of 2.1% in the prior year quarter and 5.5% in the fourth quarter of 2013.

Overall Q1 sales increased 2.2% to $1.52 billion, “despite the negative weather impact in the months of January and February,” which the company estimates adversely impacted sales by 1.5% to 2%. Operating income grew 5.7% to $85.7 million, restrained by the drop in copper prices. Operating margin of 5.6% increased by 20 basis points versus the prior year and decreased 40 basis points sequentially.

“Steadily improving market trends in all of our segments fueled strong performance, particularly in our OEM Supply – Fasteners (“Fasteners”) segment and across all segments in Europe and Emerging Markets,” Eck added.

Fastener operating margin of 5.1% increased 300 basis points versus the prior-year quarter, reflecting both gross margin improvement, as well as operating expense leverage. Sequentially, operating margin declined by 40 basis points.

“We know we still have areas of improvement in this business, but with strong top line growth and operating leverage in the quarter of 37%, we are pleased with our progress and momentum in this business,” added CFO Ted Dosch.

Eck concluded: “Our Fasteners segment continues to be energized by the results and opportunities we see for continued growth, with the anticipation of accelerating production by our heavy truck customers in North America, continued growth with existing customers in EMEA and Emerging Markets and an active pipeline of new business.”

“We are confident that this business will continue to achieve solid results through the year.”

Sale Rumors?

In the opening quarter of 2014 investors flocked to Anixter stock on speculation the company would soon be sold. Bloomberg reported that Anixter is working with Goldman Sachs Group Inc. to find a buyer. Anixter was seeking offers of more than $115 per share for a market value of $3.3 billion.

But efforts to find a buyer have seemingly stalled after at least three companies – French electrical-equipment distributor Rexel SA, and private-equity funds Advent International Corp. and CVC Capital Partners Ltd. – declined to make an offer after looking at the asset, according to Bloomberg.

During the conference call Eck was asked about the sale rumors, but he quickly declined to comment on the possibility of Anixter being sold.

“Historically,” Eck stated, “we don’t comment on media rumors about the company, and we won’t comment on this one either.”

Anixter began building its fastener business in 2002 by acquiring Pentacon for $111.4 million. After Pentacon, AFS bought Walters Hexagon in 2003, DDI in 2004, Infast in 2005 and MFU in 2006.

In 2007 Anixter bought UK-based aerospace fastener distributor Eurofast SAS for $27 million and fastener distributor Total Supply Solutions Ltd. for $8 million.

The company’s largest shareholder is Chai Trust Co., a division of Zell’s Equity Group Investments. Billionaire Sam Zell is chairman and his son is a director. ©2014 GlobalFastenerNews.com

For more on Anixter’s involvement in the fastener industry, click on the following headlines:

2002 FIN Perspective: Billionaire Zell’s Fastener Past & Future

Anixter investor Sam Zell and Ron Sackheim were high school buddies….

2003 FIN – Anixter Acquires UK Fastener Distributor Walters Hexagon

Grubbs: Walters Hexagon is “another important strategic step in building our global capabilities” to supply fasteners, wire and cable and other small components to OEMs….

2007 FIN – Anixter Continues European Acquisitions

Targeted companies include Eurofast SAS, Total Supply Solutions Ltd. MFU Holding SpA IMS and Infast….

Related Stories:

• Report: Anixter Sale Effort Stalls

• Alcoa “Very Optimistic” About Aerospace Fastener Business

• 10 Fastener Panelists Discuss Business Conditions in 2014

• Demand From China Bolsters TRW Sales & Profit

• Anixter Director Unloads Millions in Stock

• TriMas Fastener Segment Posts Strong Gains

Related Links:

• Anixter

Share: