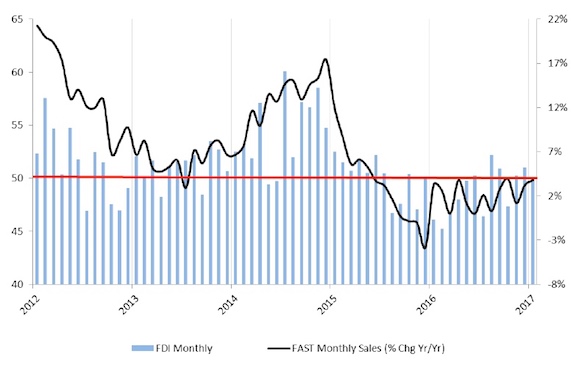

January’s seasonally adjusted FDI of 49.9 decreased slightly after two straight monthly readings (and four of the previous six) in expansionary territory.

“January sales saw good growth vs. December among distributors, with 76% of respondents noting flat or stronger selling conditions versus the preceding month,” R.W. Baird analyst David J. Manthey, CFA.

About 76% of respondents saw better or unchanged sales, up vs. December (67%), including 61% who indicated sales were better in January vs. December (highest percentage seen in any month since April 2014, according to Manthey), and another 15% of respondents who indicated sales were roughly flat.

Only 3% of respondents indicated customer inventories are too high, while 30% indicated inventories are too low vs. December levels of 13% and 31%, respectively.

Optimism continues to be prevalent, with a full 97% expecting higher or stable activity levels over the next six months, Manthey noted, with many distributors encouraged by the potential for “inflationary pro-growth” economic policies and increased infrastructure spending driven by the Trump Administration.

“While industrial markets are showing encouraging signs of potential stabilization and increased optimism, the FDI indicates that current conditions remain choppy with relatively weak demand, competitive conditions, and pricing pressure continue to weigh on results before policy changes can be implemented.”

Forward indicators are more positive, with the newly-developed FDI Forward-Looking Indicator (“FLI”) registering a seasonally-adjusted 59.8, “signaling good potential for future improvement in the fastener industry during 2017.”

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association. Web: fdisurvey.com

Share: