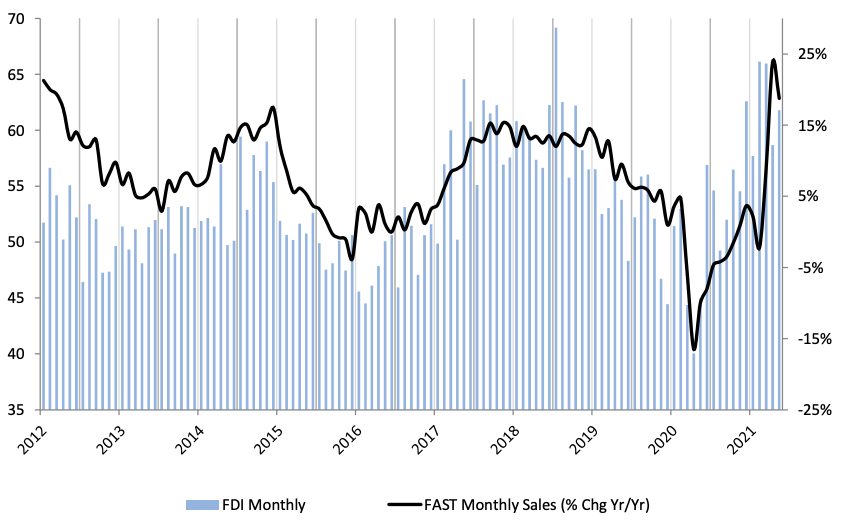

The seasonally adjusted May FDI expanded to 61.8 from the previous month’s 58.7, which had retreated amid intense supply chain/freight disruptions. Although these disruptions continued in May, improving demand conditions drove overall expansion, according to R.W. Baird analyst David Manthey.

“Nearly two-thirds of respondents saw better than seasonally expected sales, which was an improvement from the half of respondents last month,” Manthey writes.

Higher pricing has also contributed, as 86% of respondents saw higher point-of-sale pricing y/y and 76% m/m.

The seasonally adjusted Forward Looking Index retreated slightly to 76, though it remains near all-time highs “as low customer inventory levels and continued bullish six-month outlooks signal strong market conditions ahead.” Compared to April, the FLI employment component improved in May but customer inventory levels and the six-month outlook moderated slightly, leaving the FLI mostly unchanged.

The FDI employment index came in at 70.3, breaking out from the recent 66-67 range seen over the past four months. Forty-nine percent of respondents saw employment levels as above seasonal expectations in May – slightly higher vs. April’s 42%.

“Of note, some respondents this month noted employment levels would be higher at the respondent/customer level, although finding qualified labor is challenging given enhanced unemployment benefits,” Manthey writes.

Supply chain disruptions showed no signs of abating in May, and may have deteriorated further, based on respondent commentary. However, demand remains robust.

“Distributors starting to run out of critical stock, pricing continues to rise, domestic lead times continue to rise,” said one respondent. “New orders continue to be amazingly higher than last year with no sign of slowing.”

Another commented: “Continued strain in supply chain and raw materials are driving cost pressures. Transit market remains turbulent. Demand remains high.”

Amid port backups and other freight challenges, lead times continue to extend.

“Deliveries are delayed from Taiwan and from the U.S. ports and intermodals. Shortages everywhere followed by inflation across the board.”

Echoing this feedback, another participant said: “Master Distributors – Suppliers are REALLY slow in shipments and inventory to distributors. And when they do have inventory, it could be coming from anywhere in the country. Lead times are out of this world…. might as well just go fishing!”

The FDI is a monthly survey of North American fastener distributors conducted by the FCH Sourcing Network, the National Fastener Distributors Association and Baird. Web: fdisurvey.com

Share: