9/9/2015 12:32:00 AM

NEWS BRIEFS

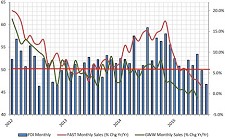

FDI Finds Weaker Sales & Stagnant Pricing

The Fastener Distributor Index dropped for a second consecutive month. The seasonally adjusted August FDI fell to 46.7, “consistent with the tough current environment for many distributors.”

“Added contraction was driven by weaker sales sentiment and a material decline in perceived customer inventories.”

Pricing, employment, and supplier deliveries were largely unchanged, while the long-term outlook for industry sentiment ticked modestly lower.

“Overall, we believe that fastener distributors continue to face material demand pressure from lower commodity prices, forex, and weaker industrial production.”

Weaker sales trends continue. Nearly 68% of respondents reported sequentially flat or lower sales for August.

“In our view, the results are consistent with sluggish recent growth from Fastenal (+1.6% yr/yr in August versus a five year average of +13.2%), Grainger (-1% in July versus FY’15 guide of 0%-2%), and MSC (company estimated +2.2% in June versus +7.6% last year).”

Reduced customer inventories also impacted results, reflecting “tightening inventories among manufacturers and reduced overall end market demand.”

The FDI found the pricing environment largely stagnant. Point-of-sale pricing for August was unchanged versus July for 73% of survey participants.

“We believe the overall environment for price increases remains notably soft given material demand pressure (declining commodity prices, forex, weaker industrial production) and minimal inflation.”

“In our view, the data reflects overall weakness within the domestic economy, and 2015 has proven difficult thus far for many industrial distributors. We believe lower energy spending is at the root of weaker sales, with currency woes further compounding the slowdown.”

The FDI and Pricing are diffusionindexes based on data supplied by FCH Sourcing Network.

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network, the National Fastener Distributors Association and BB&T Capital Markets.

Share: