4/8/2016

NEWS BRIEFS

FDI: Improving Sales Bias Encouraging

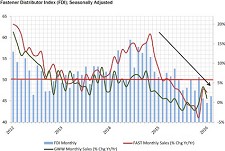

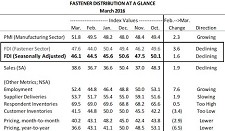

For March, the seasonally adjusted FDI (46.1) remained “in contraction territory.”

“While we believe the environment for both distributors and manufacturers remains largely strained, 59% of March respondents noted similar or better sequential sales growth, up from 41% in February.”

Hiring sentiment was also modestly improved, while responses involving pricing, deliveries, and inventory remained cautious.

“The March FDI (46.1) implies continued contraction in overall growth conditions, although declines stabilized versus February (44.5).”

The employment component of the FDI (52.4) also ticked higher in March, as 90% of participants noted unchanged or improving hiring conditions.

Regarding customer inventories, 20% of participants viewed current levels of customer inventories as “too high.”

Point-of-sale pricing for March was unchanged for 71% of survey participants.

“We believe the overall environment for price increases remains notably soft given material demand pressure (declining commodity prices, forex, weaker industrial production) and minimal inflation.”

The conclusion for March? The FDI survey “still suggests caution.”

“Anecdotal survey commentary points to choppy near-term demand for many fastener-centric distributors in H1’16, with the potential for more substantive growth in H2’16.”

As one participant noted, “The marketplace is still very volatile and unpredictable….just no true pattern to predictability.”

The FDI is a monthly survey of NorAm fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association.

Related Links:

Share: