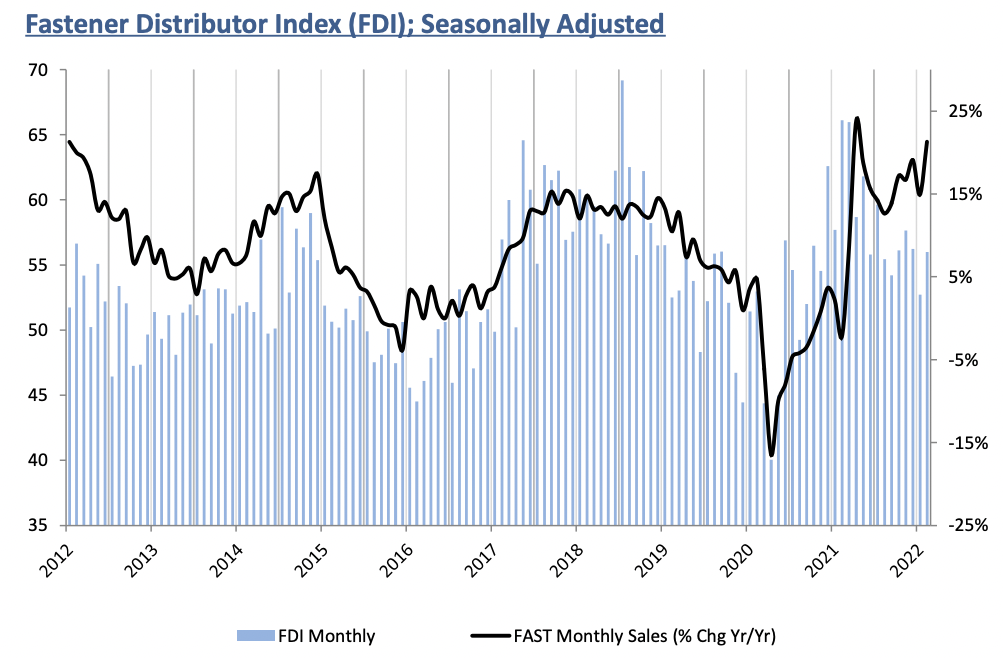

Bouncing back from a 14-month low, the seasonally adjusted Fastener Distributor Index climbed to 56 in February, up from 52.7 in January. The gain was driven by improvement in the sales index, as some respondents saw a release of previously backfilled orders caused by product availability/shipping constraints.

“Pricing continues to increase as measured by the month-to-month and year-to-year indexes,” according to R.W. Baird analyst David Manthey. “Demand feedback was again very positive (booming incoming sales), but frustration with product availability and labor shortages continues to build.”

The Forward Looking Index decelerated “sharply” to 55.6 from 62.8 the previous month, “although continuing to signal growth ahead, but at a slower pace.”

“The FLI has been on a mostly downward descent since June 2021 as supply chain issues, inflationary concerns and labor challenges have led to less rosy forecasts of future activity,” Manthey wrote. “Relative to January, a lower employment reading, higher respondent inventories and higher customer inventories were drags, partially offset by a modestly improved six-month outlook.”

Regarding the outlook, a majority of respondents (62%) indicated in February that they see similar or weaker activity levels over the next six months compared to today vs. 72% on average expecting higher activity levels back in the first half of 2021.

“However, with continued strong demand/backlog and lengthy lead times, we believe this means the FDI could remain in solid growth mode for quite some time.”

The FDI employment index dropped to 48.3 from 55 as competition for labor remains fierce, leading to higher pay, while the “Great Resignation” also continues to pressure employment.

Demand continues to outstrip supply.

“Incoming sales are booming,” one respondent said. “Now if we could just get material from our vendors it would allow us to bring delivery estimates down to better meet the needs of our distributor partners!”

In addition to material shortages, labor supply remains a constraint.

“Orders incoming are leveling off, but shipments are still strong as last year’s orders begin to ship. Product availability is still an issue. Hiring situation worsens with payrolls increasing and competition for hires heating up. Even Target is now paying $24/hour in some areas.”

The FDI is a monthly survey of North American fastener distributors conducted by the FCH Sourcing Network, the National Fastener Distributors Association and Baird. Web: fdisurvey.com

Share: