8/18/2015 1:35:00 AM

HEADLINES

FDI Reports Weaker Sales & Stagnant Pricing

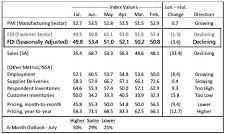

The Fastener Distributor Index dropped in July to 49.8 amid a “tough” environment for many distributors. July’s index was down from the 52 reported in June.

Sequential declines in sales, employment, and pricing were noted among survey participants, while 6-month expectations modestly improved from the previous month.

“Overall, we believe that fastener distributors continue to face material demand pressure from lower commodity prices, forex, and weaker industrial production.”

The sales index fell 48% to 35.4, while employment fell 14.7% to 52.1.

“While we note that a sequential decline in total sales is normal for July given seasonality, the percentage of respondents noting a deterioration in conditions was the highest in the survey’s brief history (January 2012).”

After rising in June, pricing month-to-month in July declined 17% to 45.8, while year-to-year pricing fell 18% to 58.3.

About 50% of distributors reported a “higher” outlook for the next six months, while 29% anticipate the “same” results and 21% predict “lower” returns.

“We believe that overall fastener sales should see some benefit from stronger res/non-res construction gains in H2’15.”

The FDI and Pricing are diffusion indexes based on data supplied by FCH Sourcing Network.

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association. This month’s reading marks the first publication by BB&TCM since May 2014, although the survey has continued during this period.

Related Links:

Share: