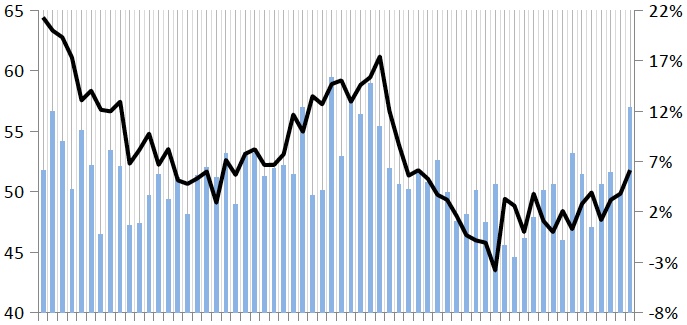

The seasonally-adjusted February FDI (57.0) increased over January’s 49.9 reading.

“Top-line sentiment remained positive for February, with 69% of respondents indicating better or unchanged sales, down slightly vs. a very strong January (76%),” according to R.W. Baird analyst David J. Manthey.

This reading included 46% of respondents who indicated sales were better in February vs. January, and another 23% of respondents who said sales were roughly flat.

“Respondents continue to indicate customer inventory levels, meanwhile, are roughly in line with expectations as only 9% of respondents indicated inventories are too high while 29% indicated inventories are too low,” Manthey noted.

The FDI Forward-Looking Indicator for February had a value of 61.0 vs. 59.8 in January, “suggesting expectations for future activity are positive and strengthening.” The FLI averaged 48.5 from January 2016 through October 2016, and has moved higher in each of the past four months since the election.

Manufacturing employment outlook improved slightly, Manthey added.

“Survey respondents again indicated a slight uptick in hiring, with 29% of respondents indicating hiring picked up in February (vs. 21% in January, 10% in December, and just 3% in November 2016).”

February represents the third consecutive month of above-50 readings for the FDI employment index following four consecutive sub-50 readings.

Commentary on current market conditions was mostly positive.

“Although not universal among respondents, most survey commentary was optimistic that market conditions could show improvement in 2017.”

Some commentary indicated orders may be picking up, as one distributor said, “We are starting to see optimism turn into orders.”

Likewise, a manufacturer alluded to an inability to keep up with market demand, saying, “We are extremely busy, can’t manufacture parts fast enough.” Manthey said price increases from suppliers are beginning to appear as foreign and domestic steel hikes mount.

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association. Web: fdisurvey.com

Share: