10/4/2012 1:55:00 AM

NEWS BRIEFS

FDI: September Settles Into “Uncomfortable Equilibrium”

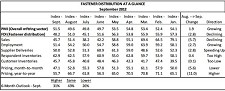

“September establishes its own trend: sluggish equilibrium (48.2, vs. 51.0 in August),” according to the latest Fastener Distributor Index.

“Technically, fastener distributors saw conditions get a little worse in September over August.”

A longer view of the U.S. distributor picture shows that from June to September the FDI has oscillated around 50, averaging 49.

The broader PMI has behaved similarly, straddling 50 and averaging 50.2 since June. Sales in September (45.7, vs. 51.4 in August) “again signaled a bit of weakening.”

The other categories – Employment, Supplier Deliveries, and Customer Inventories–were mostly unchanged from August.

Auto and construction markets stood out as relatively strong among end markets.

“A pattern has formed the past several months of stubbornly sluggish conditions,” according to the FDI. “But in as much as the step-down that occurred in June has plateaued rather than been followed by another should be taken as a positive.”

• The 6-month outlook: similarly non-committal. 31% of respondents expect activity to be higher six months from now, balanced against 26% that expect lower activity. About 43% of survey respondents expect business conditions to be the same as today. “Strikingly, these readings are little changed from those of August. The balance between those seeing things worsening versus improving and month-to-month stability points to a trendless environment, in our view.”

On pricing: “Any movement in September could be found in a continued mild worsening of pricing. We suggested pricing was very marginally worse in August, and we think the same was true in September.”

The large majority of respondents saw no change in sequential pricing, but of those who did for the first time slightly more saw it down than up. More respondents still have higher annual pricing, but by the narrowest margin since the FDI began.

“We still see year-to-year pricing up 1%–2% in September. But the likelihood remains high it will continue to trend toward 0% over the near term as past increases anniversary.”

The FDI is a monthly survey of North American fastener distributors. As a diffusion index, readings above 50 signal strength and below 50 signal weakness.

The FDI is a joint production of BB&T Capital Markets and the FCH Sourcing Network, the online network for industrial fasteners. ©2012 GlobalFastenerNews.com

Share: