11/20/2015 4:26:00 AM

NEWS BRIEFS

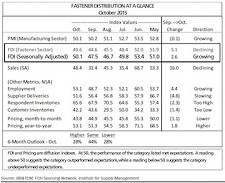

For October, a seasonally-adjusted headline reading of 50.1 marked the first sequential improvement for the index since June. Contributing to the positive seasonally-adjusted print were sequential gains in both sales and employment sentiment.

Pricing and customer/respondent inventories were largely unchanged.

“While the sequential improvement is encouraging, we remain notably cautious on the overall environment for fastener distribution. We would also note that the FDI’s six-month outlook for improving industry sentiment has now slipped to a putrid 28%.”

October sales sentiment improves versus September.

For October, the FDI returned to positive territory (50.1) for the first time in three months. Of the items measured (sales, employment, delivery times, inventories, customer inventories),weaker top-line sentiment remains the most

directionally accurate indicator in the Index. 63% of total respondents reported sequentially flat or improving sales for October.

“Overall, the majority of fastener distributors continue to see material sales pressure across many diverse end markets.”

Employment also ticks higher. The October employment index (53.1) showed a slight improvement in hiring sentiment versus the prior month.

“While current overall hiring remains tepid for many fastener distributors, the increase versus September is modestly encouraging.”

Pricing largely stagnant

Point-of-sale pricing for October was unchanged versus September for 69% of survey participants.

“We believe the overall environment for price increases remains notably soft given material demand pressure (declining commodity prices, forex, weaker industrial production) and minimal inflation.

Six-month outlook still notably cautious

While the sequential uptick in sales is encouraging, overall sentiment continues to reflect ongoing weakness within the domestic economy, and 2015 has proven

difficult thus far for many industrial distributors.

“We believe lower energy spending is at the root of weaker sales, with currency woes further compounding the slowdown. Recent conversations with private industry contacts suggest continued pressure on manufacturing demand for the latter portion of FY’15 (72% of FDI respondents now expect flat-to-weaker conditions six months from now).

The FDI is a monthly survey of NorAm fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association.

Share: