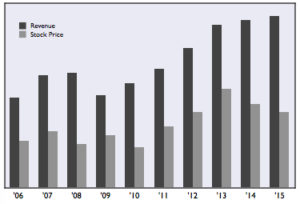

2015

In 2016, Berkshire Hathaway agreed to acquire Precision Castparts Corp. for $37.2 billion cash, including outstanding PCC net debt. The price equals about $235 per share.

“I’ve admired PCC’s operation for a long time,” said Warren Buffett, Berkshire Hathaway chairman and CEO. “For good reasons, it is the supplier of choice for the world’s aerospace industry, one of the largest sources of American exports.”

“I’ve admired PCC’s operation for a long time,” said Warren Buffett, Berkshire Hathaway chairman and CEO. “For good reasons, it is the supplier of choice for the world’s aerospace industry, one of the largest sources of American exports.”

“We see a unique alignment between Warren’s management and investment philosophy and how we manage PCC for the long-term,” PCC CEO Mark Donegan stated. “We believe that as part of Berkshire Hathaway, PCC will be exceptionally well-positioned to support our customers’ needs into the future.”

Precision Castparts reported Airframe Products sales, including fasteners, declined 9% to $746 million in the second quarter of fiscal 2016, driven by lower aerospace and general industrial sales.

Precision Castparts reported Airframe Products sales, including fasteners, declined 9% to $746 million in the second quarter of fiscal 2016, driven by lower aerospace and general industrial sales.

Commercial aerospace was modestly lower, driven by continued inventory management efforts by key fastener customers. Aerostructures demand declined versus the prior year’s rapid growth due to the disruptive impact of new programs moving out of development and into production.

Regional/business jet and military sales were also lower by double digits, primarily reflecting difficult year-over-year comparisons and lower military demand.

“The segment remains focused on delivering to its customers’ demand in support of the next generation of commercial aerospace programs, and is well-positioned with multi-year contracts in place,” PCC stated.

Airframe Products operating income fell 23% to $191 million, and operating margins decreased 480 basis points from 30.4% to 25.6%, reflecting lower volumes and product mix, coupled with higher costs associated with new product introductions.

Consolidated PCC sales during Q2 declined 9% to $2.3 billion. Operating income fell 22% to $548 million.

2014

Precision Castparts Corp. reported fiscal fourth-quarter sales in its Airframe Products segment – primarily fasteners – grew 1% to $789 million, driven by 7% growth in commercial aerospace sales, offset by lower military and general industrial sales.

Segment operating income grew 2% to $237 million, and operating margins increased 30 basis points to 30%, driven by solid leverage of increased throughput and the benefit from acquisitions.

Full-year Airframe Products revenue rose 11.4% to $3.2 billion, while segment operating income gained 12.2% to $968 million.

Billionaire investor Warren Buffett’s Berkshire Hathaway increased its stake in Precision Castparts Corp. in the fourth quarter of 2014 despite disappointing earnings in the previous fiscal quarter.

Precision Castparts stock lost more than 13% this year.

A range of issues have hindered the company’s performance in recent months, from ongoing weakness in military demand to sales deterioration from its oil-and-gas-based customers.

Sales in its Airframe Products segment, including fasteners, grew 11% to $798 million in the third fiscal quarter of 2015, driven by 17% growth in commercial aerospace sales during the fiscal Q3 2015.

“Fastener operations continue to maintain a high level of activity to meet aerospace production schedules and to benefit from the rapid integration of the most recent acquisitions,” PCC stated.

Segment operating income rose 12% to $241 million, and operating margins increased from 29.9% to 30.2%, driven by “solid leverage of increased throughput and the benefit from acquisitions.”

Nine-month Airframe Products segment sales improved 15.2% to $2.4 billion, with segment operating income rising 15.8% to $731 million.

Overall fiscal Q3 sales increased 5% to $2.46 billion, with consolidated operating income up 2% to $670 million and net income from continuing operations gaining 3% to $442 million.

2013

Precision Castparts Corp. (PCC) reported Airframe Products sales, including fasteners, improved 15% to $781 million in the fourth quarter of fiscal 2014, which ended March 31. Segment operating income grew 18% to $232 million, or 29.7% of sales.

“Fastener 787 shipments are now at an average of eight shipsets per month, with additional upside opportunity expected as they close the gap with aircraft production schedules,” the company stated.

Full-year Airframe Products revenue, including fasteners, rose 24.5% to $2.88 billion, with segment operating profit up 25.6% to $863 million.

Overall PCC sales increased 15% to $9.6 billion, with net income growing 25% to $1.78 billion.

In April 2014, PCC acquired Aerospace Dynamics International (ADI) for $625 million cash.

Valencia, CA-based ADI operates a range of high-speed machining centers that supply the aerospace industry, with particular expertise in large complex components, hard metal machining, and critical assemblies. ADI has strong positions across high growth commercial platforms, including a significant presence on the Airbus A350. PCC is already a major supplier to Boeing’s 787 Dreamliner.

“The PCC Aero-structures team, led by Andrew Masterman and Joe Snowden, will aggressively work with other PCC locations to provide the fasteners, forgings, and castings that ADI currently purchases on the outside,” stated CEO Mark Donegan.

2012

Precision Castparts reported Fastener Products’ revenue grew 26% to $1.7 billion in fiscal 2013, which ended on April 1. Fastener Products operating income grew 19% to $488.1 million.

This segment experienced a solid recovery in aerospace sales compared to the prior year, which increased approximately $330 million, or 35%, driven by a steady acceleration in orders for the segment’s critical aerospace core fastener products and the contribution from acquisitions.

“While the gap between order levels and commercial aircraft production rates continued to close, the segment still lagged the build rates as customer inventory levels continued to be depleted.”

The increased volume of core product running through the Fastener Products businesses is starting to drive solid incremental drop-through, but operating margins were reduced by 1.7% percentage points due to lower-margin sales from fiscal 2012 acquisitions in fiscal 2012.

The Fastener Products segment is expected to benefit when Boeing 787 production schedules accelerate and core aerospace product sales recover. PCC also expanded its presence in the aerostructures business with the acquisition of Centra Industries in the first quarter of fiscal 2013.

“Aerostructures will continue to be a platform for our long-term profitable growth.”

“Airframe Products showed solid year-over-year aerospace growth, with strong leverage as critical aerospace fastener volumes continued to accelerate after an extended period of destocking,” stated CEO Mark Donegan.

PCC’s Fastener Products segment operates 62 facilities, including 40 in the U.S.

Net direct sales to General Electric Company in fiscal 2013 were 15.4% of overall sales, accounting for $85.1 million in fasteners.

Precision Castparts reported sales at its Airframe Products segment — primarily fasteners — grew 35.8% to $556.9 million in the second quarter of fiscal 2013, driven by a 51% increase in aerospace sales that represented a “steady recovery in core fasteners.”

“The segment’s organic aerospace sales increased by 15%, driven by steadily increasing commercial backlogs and further closing of the gap between 787 fastener orders and the current Boeing production rate,” PCC stated.

Segment operating income gained 43.5% to $166.6 million during the period.

“Airframe Products is delivering positive results on a number of fronts – the recovery of core fastener volumes, the successful integration and accelerating improvement of Primus and Centra, and still-to-be-realized performance from recently deployed capital for additional aerostructures acquisitions,” stated CEO Mark Donegan.

Overall PCC sales rose 8.4% to $1.93 billion, while operating income increased 13.5% to $498.4 million and net income from continuing operations improved 12.5% to $333.3 million.

Six-month Airframe Products segment sales rose 38% to $1.05 billion, with operating income up 40% to $312.8 million.

Fastener Products sales increased 42% to $492.8 million in the first quarter of fiscal 2012, which included a full quarter of Primus and a partial quarter of sales from Centra. Segment operating income rose 37% to $146.2 million, or 29.7% of sales.

Fastener Products orders for the 787 program are gradually aligning with build rates, PCC stated.

“Base critical aerospace fastener sales showed more than 15% growth year over year due to base aircraft production increases, slowly improving 787 orders, and heightened distribution activity, and the segment’s aerostructures businesses, including the newer acquisitions, are seeing steady top-line improvement as well,” the company stated.

“Operationally, the base aerospace fastener businesses are starting to drop through solid incremental margins as larger volumes are leveraged across much improved cost structures, and the aerostructures operations are performing beyond initial expectations and driving their margins higher.”

During the period PCC agreed to acquire certain aerostructures business units and McSwain Manufacturing from Heroux-Devtek Inc. for $296.2 million.

Heroux-Devtek’s aerostructures operations manufacture components and assemblies from aluminum, aluminum-lithium, and titanium, such as bulkheads, wing ribs, spars, frames, and engine mounts. The aerostructures operations include Progressive Machine in Arlington, TX, as well as plants in Dorval (Montreal), Canada, and Queretaro, Mexico. Collectively these three businesses will be reported as part of PCC’s Fastener Products segment.

“All of our businesses are well-positioned for the future; the long-range growth prospects for the top- and bottom-line are solid,” stated CEO Mark Donegan.

“Wyman-Gordon and SPS Technologies demonstrated our ability to establish a beachhead in an industry and progress aggressively forward, and we are confident that these aerostructures businesses will give us the same traction,” Donegan added.

Overall PCC sales increased 17.6% to $1.97 billion during fiscal Q1, with operating income up 23% to $515.5 million and net income gaining 20% to $344 million.

2011

Precision Castparts reported Fastener Products’ revenue grew 42% to $487.9 million in the final quarter of fiscal 2012, which ended on April 1. Q4 sales included full quarter results from Primus and PB Fasteners.

Base aerospace sales grew by approximately 15%, “driven by some encouraging pick-up in orders for the segment’s critical aerospace core fastener products in the last two quarters of the fiscal year, a trend that now appears to be moving along a steady upward slope.”

PCC said the gap between the higher order levels and commercial aircraft production rates continued to close.

“In terms of the aerostructure products within the segment, sales are basically tracking the increases in commercial build rates, with strong upside potential as the 787 ramps up.”

CEO Mark Donegan said the ramp-up of the 787 program “is just beginning to get exciting.”

Fastener Products operating income improved 33% to $139.5 million, or 28.6% of sales, compared to segment operating income of $105 million, or 30.5% of sales last year. The increased volume of core product running through the base fastener businesses is starting to drive “solid incremental drop-through.”

“As our first major move into aerostructures, Primus is proving to be everything we expected and more,” Donegan stated. “These operations have set aggressive goals for improvement and are well on the way to achieving them, which should get Fastener Products back to 30% operating margins before the end of fiscal 2013.”

Full-year Fastener Products revenue grew 26% to $1.7 billion, while operating income rose 19% to $488.1 million.

“PB Fasteners improves our position on the 787, and the value of their technology on composite-based aircraft will put us in a good position on other new, advanced aerospace platforms.”

2010

Overall PCC sales climbed 13.9% to $6.22 billion, with net income growing 10% to $1.01 billion.

2009

Precision Castparts reported Fastener Products sales for fiscal 2010 dropped 12% to $1.4 billion, while segment operating income declined 4.3% to $439.3 million, or 32.5% of sales.

Those results included a 13% sales drop to $333.6 million during the final fiscal quarter, along with a 9% dip in segment operating income to $108.4 million.

“With aerospace destocking at an end, direct aerospace OEM orders are seeing a gradual recovery, with solid upside in the second half of fiscal 2011 in response to the ramp of 787 production and higher aircraft build rates,” the company stated.

“The Investment Cast Products and Fastener Products segments demonstrated their ability to deliver continued performance improvement in less than optimal market conditions,” stated CEO Mark Donegan said.

Overall sales at PCC dropped 19.3% to $5.5 billion, with net income declining to $924.3 million.

2008

Precision Castparts’ fastener sales climbed 14% to $1.6 billion during fiscal 2009, which ended March 31. Operating income from fasteners grew 23% to $459 million (29.5% of sales).

PCC reported “year over year, operating margins also improved” in the fastener segment as “each plant continues to drive cost improvements and increased productivity.”

Fourth quarter fastener totaled $386.3 million, up from $377.7 million the previous year. Q4 operating income rose 11.8% to $118.5 million (30.7% of sales).

“The segment capitalized on continued market share growth to overcome the negative pressures of foreign currency and softening in the business jet market” during Q4, PCC stated.

Corporate highlights for Portland, OR-based PCC included record consolidated segment operating income margin of 24.9%, EPS from continuing operations of $1.87 and cash of $555 million against total debt of $306 million.

Overall sales at PCC rose to $6.8 billion, with net income gaining 4% to $1.04 billion.

HISTORY

Precision Castparts forged a powerhouse fastener division that includes Cherry Aerospace, Air Industries and Shur-Lok. Precision Castparts assembled its fastener division by acquiring SPS Technologies in 2003 for $893 million and airframe fastener maker AIC in early 2005 for $194 million.

PCC also manufactures thread rolling dies and header tooling for fastener machinery.

PCC supplies structural and airfoil components for the aircraft engine and industrial gas turbine industries and has diversified into non-aerospace businesses.

PCC’s Fastener Products segment operates more than 60 facilities, including 40 in the U.S.

Corporate Office: 4650 SW Macadam Ave., Portland, OR 97201-4254.

Tel: 503 417-4800 Fax 503 417-4817

Web: precast.com

CEO: Mark Donegan

Employees: 28,510

Share: