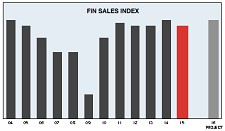

FIN SURVEY: Moderate Fastener Sales & Profit Gains in 2015

Last year was neither the best or worst of times for U.S. fastener companies.

After four consecutive years of widespread sales and profit increases, the End of 2015 FIN Survey found revenue gains tightened in 2015.

Sales: Nearly 60% of survey respondents reported higher sales, with nearly 40% of those gains described as “moderate” in 2015.

Profit: About 58% of fastener manufacturers, importers, distributors and platers reported increased profit. Just over 21% said profits were unchanged from the year before, and 18% reported declining profit.

Costs: The End of 2015 FIN Survey found costs moderated, with 52% of participants reporting flat or declining costs.

Capital Expenditures: And 46% of fastener companies reported a “moderate” to “strong” increase in capital expenditures during 2015

Company Performance: And for the third consecutive year, the FIN Company Performance Index dipped in 2015.

Prices: About 39% of fastener businesses successfully raised prices in 2015, though the increases were more moderate than the previous year.

Operating Capacity: Fastener manufacturers reported operating at a range from 60% of capacity to 100% in 2015, with an average of 62%.

Workforce: The pace of job growth in the fastener industry slowed in 2015. About 51% of fastener companies expanded their workforce last year.

FIN Subscribers can read the full End of 2015 FIN Survey results by clicking here.

Related Stories:

• U.S. Fastener Exports Flat, Imports Up for 2015

Share: