2/23/2015 2:00:00 PM

NEWS BRIEFS

KLX Eyes Bright Energy Segment Future

![]()

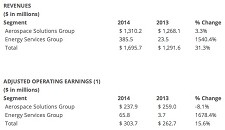

KLX Inc. – the former Consumables Management segment of B/E Aerospace – reported 2014 revenues grew 31.3% to $1.7 billion, while adjusted operating earnings increased 15.6% to $303.7 million.

“2014 was a solid year for the businesses which comprise KLX,” stated CEO Amin Khoury. “Exclusive of one-time costs, we reported strong contributions for both the full year and latest quarter from our energy services segment, which complemented the performance of our industry leading aerospace solutions group.”

Full-year aerospace solutions group (ASG) segment revenues gained 3.3% to $1.3 billion, with operating earnings of $237.9 million, or 18.2% of revenues. On a GAAP basis, ASG operating earnings were $192 million.

“Revenues associated with supporting aerospace manufacturing customers increased by 5.3%,” Khoury explained. “However, defense sales were down and aftermarket sales were flat.”

Khoury added that the “strong new aircraft delivery cycle” and new customer contracts generated an increase in ASG’s revenues to support the global aerospace manufacturing base.

Khoury also predicted increased business jet production in 2015.

“The outlook for defense sales will remain tied to the procurement budgets approved by Congress, in response to the ongoing need for a strong U.S. military presence to counter global challenges.”

Energy services group segment (“ESG”) revenues were $385.5 million in 2014. Adjusted operating earnings were $65.8 million, and adjusted operating margin was 17.1%. On a GAAP basis, ESG operating earnings were $54.8 million.

“This was an auspicious first year for our ESG business,” Khoury noted. “During the past year seven companies have been acquired, enabling the development of a cohesive energy services business with a broad range of services and a solid geographic footprint.

“Over this short period of time, the management teams of the legacy businesses have begun working together in an integrated matrix organization aimed at driving growth and accountability on both a regional and service line management basis.

“While the recent precipitous decline in oil prices has put pressure on our energy franchise, we are taking every measure to ensure ESG is in position to take advantage of the extraordinary opportunities which will occur as a result of these industry conditions.”

Fourth-quarter revenues increased 35.9% to $440.7 million, while adjusted operating earnings, excluding spin-off costs, rose 24% to $79 million, and adjusted operating margin was 17.9%.

Fourth quarter 2014 Adjusted Net Earnings and Adjusted Net Earnings per diluted share were $64.4 million and $1.23 per share, respectively. On a GAAP basis, to reflect costs and expenses related to the spin-off, acquisitions and restructuring, net loss and loss per diluted share were $32.6 million and $0.62 per share, respectively.

Q4 aerospace revenues were $317 million, adjusted operating earnings were $58.1 million and adjusted operating margin was 18.3%. Revenues associated with supporting the global aerospace manufacturing base increased 6%, while defense sales declined 6% and aftermarket sales dropped 3%.

Q4 energy revenues were $123.7 million, adjusted operating earnings were $20.9 million, and operating margin was 16.9%.

KLX began trading as an independent public company on December 17, 2014. The company’s capital structure consists of $1.2 billion of 5.875% senior unsecured notes due December 2022 and a five year $500 million revolving credit facility.

The company’s cash balances stood at approximately $470.8 million, and long-term debt net of cash was $729.2 million.

Related Stories:

• Anixter Selling Fasteners Division for $380 Million

• Deal Reached For U.S. West Coast Ports

Related Links:

• KLX Inc.

Share: