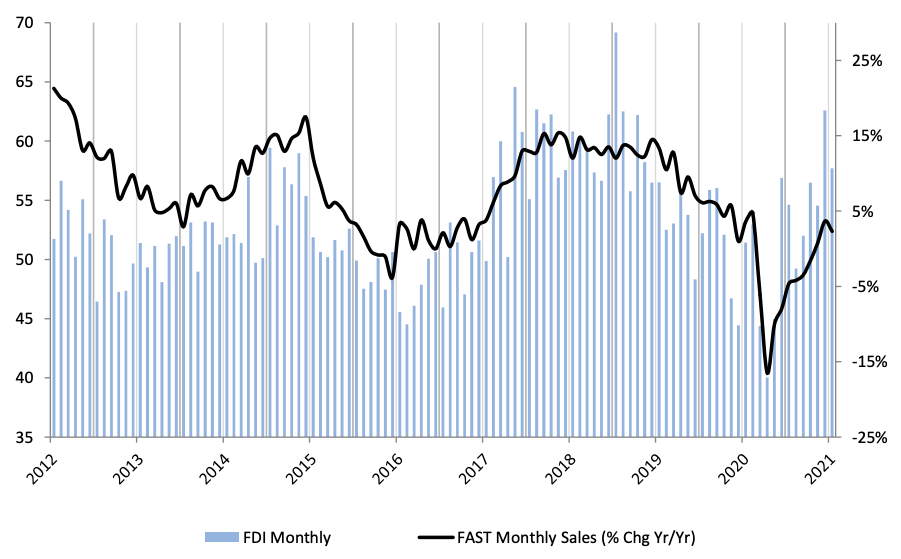

The Fastener Distributor Index (FDI) slowed to 57.7 in January from 62.6 in December “due to the seasonal adjustment factor which slightly adjusted the FDI downward, as January is typically a very strong month relative to seasonal expectations,” according to R.W. Baird analyst David Manthey.

Seven in 10 respondents saw better than seasonally expected sales in January.

“Pricing continued to move higher and multiple respondents commented on the various inflationary pressures in the market, including freight rates for imported materials/the ongoing shipping container shortages, significant steel inflation, material shortages, and FX rates,” Manthey wrote.

The seasonally adjusted Forward Looking Index improved to 66.7 from 65.7 in December. Nearly all components of the FLI (employment, respondent inventories, customer inventories) improved vs. December, with the six-month outlook the lone component to decrease slightly month to month.

“With the FLI well above 50, customer inventories getting increasingly low, and respondents continuing to forecast favorable six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued improvement particularly as y/y comparisons ease significantly beginning in March/April,” according to Manthey.

The FDI employment index rose to 64.3 in January vs. 58.8 in December. Nearly 35% of respondents saw employment levels as “above seasonal expectations” compared to 24% in the previous month.

Transportation issues and inflation dominated respondent commentary.

“Nearly every comment touched on current logistics and transportation issues. Freight appears to be one factor driving pricing higher for many respondents, in addition to raw material shortages and steel price increases.”

“Logistics and transportation [are] a mess,” a respondent noted. “Steel prices are out of control, and supply is limited. Automotive customers’ schedules are erratic due to supply chain pressures and inability to get everything needed. And Lunar New Year starts soon!”

Another commented: “The steel crisis and crisis on the west coast are very concerning.”

Many seem to be forecasting logistics headwinds to persist through at least the first half of this year.

“We expect upward pressure to continue in terms of cost and pricing, supply to be tight, and continued challenges in the logistics markets for at least the first half of this year,” another respondent noted.

“The issues with container capacity and issues at the ports will slow the supply chain in Q1 maybe into Q2,” one responded commented. “The exchange rate could be a lingering factor to the price increases happening.”

Significant supply chain issues weighed on the six-month outlook, which was slightly less optimistic with 69% of respondents now forecast higher activity levels six months from now vs. today compared to 79% last month.

The FDI is a monthly survey of North American fastener distributors conducted by the FCH Sourcing Network, the National Fastener Distributors Association and Baird. Web: fdisurvey.com

Share: