4/7/2016 12:33:00 AM

NEWS BRIEFS

Lower Demand Hurts MSC Industrial Results

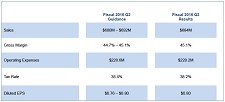

MSC Industrial Supply reported sales, including fasteners, declined 3.2% to $684.1 million in the second quarter of fiscal 2016. Operating income fell 6.2% to $80.5 million, while net income dropped 3.9% to $49.5 million.

Gross margin was 45.1%, with operating margin of 11.8% “driven by tight operating cost control and ongoing productivity improvements.”

“The market environment during our fiscal second quarter remained challenging, consistent with continued low levels of demand in the industrial economy and particularly in metalworking and heavy manufacturing,” stated CEO Erik Gershwind. “Continued share gains, as well as strong execution on our gross margin countermeasures and cost reduction initiatives, helped offset this ongoing weakness.”

CFO Rustom Jilla added: “Our second quarter gross margin and EPS were both at the top of our guidance range, while average daily sales and operating expenses were in-line with our guidance.

“Our strong cash flows for the quarter reflect our working capital management, including a reduction in inventory, which we achieved while maintaining the very high service levels that define our competitive advantage.”

During the first half of fiscal 2016, which ended February 27, sales declined 3.2% to $1.39 billion, with gross profit down 2.9% to $763.2 million and net income falling 4% to $104.5 million.

Based on current market conditions, MSC expects net sales for the fiscal 2016 third quarter to be between $729 million and $741 million. At the midpoint, average daily sales are expected to decline roughly 3% compared to the prior year period.

Share: