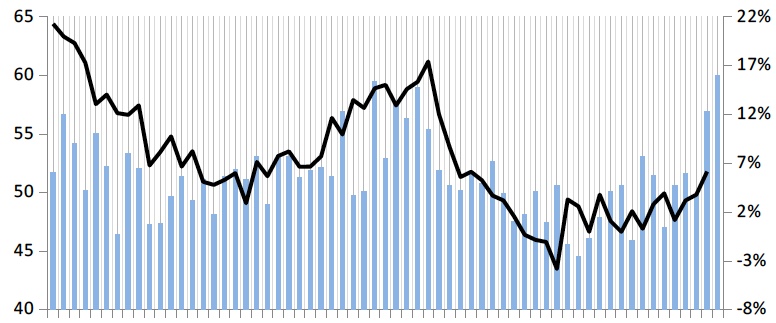

“The seasonally adjusted March FDI (60.0) increased over February’s strong 57.0 reading, achieving the highest reading seen in the Fastener Distributor Index Survey’s 5+ year history,” according to R.W. Baird analyst David J. Manthey.

Top-line sentiment remained positive for March, with 93% of respondents indicating better or unchanged sales, up vs. February’s 69% reading. This level includes 68% of respondents who indicated sales were better than expected in March vs. February (highest since January 2013), and another 24% of respondents who indicated sales were roughly flat.

“Although not universal, commentary on current market conditions was mostly positive, as several respondents noted strong y/y and m/m sales growth, as well as favorable end-market dynamics,” Manthey wrote.

Respondents continue to indicate customer inventory levels are roughly in line with expectations, as only 10% of respondents indicated inventories are too high while 22% indicated inventories are too low.

However, the manufacturing employment outlook dropped.

“Survey respondents indicated a slight deceleration in hiring vs. February, with 24% of respondents indicating hiring picked up in March (vs. 29% in February, 21% in January, and 10% in December).

Price increases from suppliers related to commodity price inflation continue, with one distributor noting: “Continuing to get steel price increases from both overseas and domestically.”

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and the National Fastener Distributors Association. Web: fdisurvey.com

Share: