7/6/2015 1:19:00 AM

HEADLINES

PERSPECTIVE – Beaulieu to NFDA: U.S. Economy In Good Shape

The U.S. economy is in good shape, economist Dr. Alan Beaulieu declared.

Unemployment is down and manufacturing is up. The leading indicators are pointing up. The world is relatively calm. Banks are lending. Retail sales are rising. Non-residential construction is improving.

“The recession ended in 2009,” Beaulieu of ITR Economics told the National Fastener Distributors Association. “Think of how to grow.”

Interest rates are low, Beaulieu added. “This is the time to borrow. Borrow until you can’t sleep again. Borrow until your banker can’t sleep.”

Employment is rising and after downsizing due to the past recession. “Companies are right-sized,” Beaulieu finds.

Beaulieu noted a recent Fox News poll found 65% of America “thinks we are in a recession. Wrong!” he retorted. Declaring the current economy almost the “Roaring 20’s,” Beaulieu asked, “How can so many people be wrong?”

“They are suffering from a recession hangover,” Beaulieu suggested.

When a NFDA member suggested the negative rating may be politically-motivated, Beaulieu agreed. He noted a Colorado senator elected last November recently gave a negative speech about the economy.

“He is wrong. He must still be giving his stump speech,” Beaulieu said.

Though for a few recent months, some industries have shown some slowing, the U.S. economy is “not heading toward breakdown.”

“Think of how to grow,” he advised.

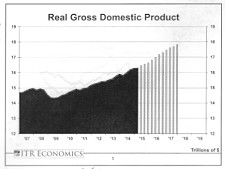

Beaulieu. who describes himself as a “Austrian business-oriented economist rather than a Keynesian government-oriented economist,” displayed graphs showing the U.S. Industrial production and real gross domestic product growing since the recession and ITR’s projections for continued expansion through the first half of 2018.

By late 2018 through 2019 there will be a “consumer-led recession,” but it will be mild compared with 2008, Beaulieu predicted.

ITR Economics projects an economic depression about 2030. Beaulieu emphasized that it will be a “depression” rather than the “recession” of 2008.

Excerpts from Beaulieu’s NFDA presentation entitled, “Prosperity in the Age of Decline”:

• Health care costs are an issue, Beaulieu said. The costs are driven by the U.S. aging population of Baby Boomers. In previous generations the first major illness would kill seniors. Now many conditions can be cured or controlled.

People over 65 get out to vote and Congress isn’t likely to cut benefits to voters, Beaulieu explained. In contrast, younger Americans vote in smaller numbers.

• Congress will not act on the national debt, Beaulieu predicted. There simply isn’t pressure to seriously change spending or taxes.

• The 2016 presidential and congressional election results won’t alter his economic predictions. No matter which party wins, it takes a year to legislate changes and longer yet to implement, he explained.

“Your vote as far as the economy is concerned is ‘meaningless’,” he told the NFDA.

• Expect oil prices to be up in 2016.

• At just over 2% the delinquency rates on consumer loans is well-below the 10-year numbers of 3.2% to 4.0%.

• Poverty in the U.S. is down; the middle class is stable; and the rich are stable – or even “getting richer fastener,” Beaulieu observed. Those making $200,000 annual income total 4.8% in 2013 – in 1997 it was 0.9%.

• U.S. auto exports are topping 100,000 – compared with less than 30,000 around 2010.

• Greece’s economic problems are not a world problem, Beaulieu said. “Greece is just not important globally,” he explained. The world is not dependent and any products from Greece.

German investors have already factored in Greece’s debt problems, Beaulieu pointed out.

• Lower unemployment means the rate of employees quitting is rising. It also means higher wages – which means inflation is coming, he added.

ITR Economics’ pegs the private sector employment growth at 2.5%; job openings at 20.8%; involuntary part-time employment has dropped -9.7%.

• China faces a debt problem. The nation is “waiting for the middle class to grow,” Beaulieu observed. It is rarely talked about here, but until China’s middle class grows the nation will have “see-through buildings.”

• In contrast to the U.S., the Russian economy “is getting punished by (low) oil prices, Beaulieu finds. The ruble is turning to rubble.”

Other nations should be leery of Russia, because the “Russian bear can be aggressive” if Putin needs a war or other aggression to offset a poor economy.

The U.S. has oil and gas and can be energy independent, Beaulieu said.

• In addition to China’s debt and Russia’s instability over low oil prices, the S&P 500 could give way to steeper-than-median decline; Europe is slowing; and higher affordable care costs sap consumers.

Founded in 1948, ITR Economics is a economic research and silting firm which boasts a 94.7% accuracy rate in its projections. Web: itreconomics.com

Share: