4/27/2015 10:37:00 PM

HEADLINES

Reports Show Mixed Q1 Fastener Results

Early sales figures indicate strong fastener performance in the opening quarter of 2015. But income results were mixed, with Alcoa reporting record fastener segment income and MSC income declining.

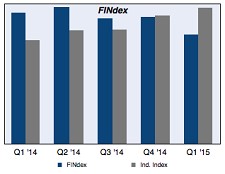

The FIN Fastener Stock Index fell 6.9% in the opening quarter of 2015, reversing gains made during the final quarter of 2014. A comparative index of related industrial stocks rose 2% in Q1. Only seven of the 20 public fastener companies tracked by the FINdex gained share value in Q1.

Record Sales & Income for Alcoa’s Fastener Segment

Alcoa reported Engineered Products segment sales, including Alcoa Fastening Systems, grew 17% to a record $1.69 billion in the opening quarter of 2015. After-tax operating income (ATOI) was a first quarter record of $191 million, up $2 million, or 1%, year-over-year, and up $26 million, or 16%, sequentially.

MSC Profit Drops Despite Sales Gains

MSC Industrial Supply reported net sales for the fiscal second quarter of 2015 rose 6.8% to $706.4 million. Adjusted operating income fell 3.9% to $86.3 million, or 12.2% of net sales, compared to $89.8 million, or 13.6% of net sales, in the same quarter a year ago. Adjusted net income declined 5% to $51.8 million.

“We have seen a significant and swift change in the demand environment since the start of the calendar year due to the impact of the rapid drop in oil prices, softening export demand and poor weather,” stated CEO Erik Gershwind.

Fastener Sales Up at Stanley Black & Decker

Stanley Black & Decker reported its Engineered Fastening business achieved 12% organic sales growth in the opening quarter of 2015, driven by strong global automotive and electronics revenues.

“We posted strong organic growth and operating leverage in our Tools & Storage and Engineered Fastening businesses in the face of a challenging currency environment,” stated CEO John Lundgren.

Overall Q1 revenue grew 1% to $2.6 billion, with 8% organic growth offset by 7% currency impact.

The company’s gross margin rate for the quarter was 37%, up 50 basis points from the prior year rate of 36.5% as a result of favorable volume, price, productivity and cost actions which more than offset unfavorable currency.

Nucor Fastener Segment Sales Decline

Nucor Corp. reported Cold Finished Steel sales, including results from Nucor Fastener, declined 6% to 130,000 tons in the opening quarter of 2015.

Nucor’s consolidated net sales decreased 14% to $4.4 billion in Q1. Average sales price per ton fell 5%. Total tons shipped to outside customers declined 9% to 5.6 million tons. Total first quarter steel mill shipments decreased 10%.

Q1 downstream steel products shipments increased 1% over the first quarter of 2014 and decreased 4% from the fourth quarter of 2014. The average scrap and scrap substitute cost per ton slipped 19% to $324.

“We expect to further benefit from the large decrease in scrap prices that occurred in February during the 2nd quarter of 2015, as we finish consuming scrap and pig iron purchased before the February price correction.”

ITW Fastener Segments Report Organic Gains

ITW reported Automotive OEM segment revenue, including fasteners, declined 2.2% to $653 million in the opening quarter of 2015, despite a 7% organic increase in sales, outperformed worldwide auto builds of 1%. Organic revenues increased 13% in Europe, 3% in North America and 14% in China. Segment operating margin improved 170 base points 25%.

Construction Products revenue, including fasteners, declined 8% to $381 million, with sales in North America up 5%, sales in Asia Pacific and Europe up 1%. Segment operating margin improved 180 base points to 16.6%.

Overall ITW revenue in Q1 dropped 6.3% to $3.34 billion, with operating income rising 4.5% to $697 million and net income declining 3.2% to $458 million.

Fastener Sales Growth Slows At Fastenal

Fastenal Co. reported fastener sales rose 5.5% in the first quarter of 2015 — well below the company’s fastener sales growth rate of 11.4% in the final quarter of 2014. The increase was related to volume, with “some price deflation” in Fastenal’s fastener line.

“(Our fastener) business really slowed down,” CEO Lee Hein noted in a conference call to investors. “We didn’t lose any customers but those customers are producing fewer widgets and therefore they need fewer fasteners.”

Overall Q1 sales gained 8.8% to $953.3 million. Net earnings grew 14% to $127.6 million and EPS increased 13.2% to $0.43.

Fastenal continued to hire, increasing its workforce 9% to 12,907. In the last several months, the company has added 1,067 people to its stores. Fastenal also closed 13 stores during Q1, bringing its overall store count to 2,624.

The number of industrial vending machines in operation increased 15.2% to 48,545 in Q1.

Grainger Reports “Challenging” Results

Grainger reported first quarter sales, including fasteners, increased 2% to $2.4 billion, which consisted of a 1 percentage point increase from acquisitions and a 3 percentage points reduction from foreign exchange. Organic sales increased 4% on volume. Q1 net earned declined 3% to $211 million and EPS was flat at $3.07.

“This was a challenging quarter,” stated CEO Jim Ryan. “Our results were affected by continued headwinds from the strong U.S. dollar and weakness in the oil and gas sector in North America.”

FIN subscribers can read a summary of the last seven years of fastener stock results in the FIN Stock Review section of GlobalFastenerNews.com.

Related Stories:

• Murphy to Update AWPA on Steel Market

• Fastener Sales Growth Slows At Fastenal

Share: