2/8/2013 1:03:00 AM

NEWS BRIEF

Simpson Manufacturing Co. reported sales increased 10.7% to $144.7 million in the fourth quarter of 2012, with net income gaining 20% to $5.9 million, which included a $9.9 million tax benefit.

“The increase in the Company’s fourth quarter 2012 sales was primarily due to $8.8 million in sales from businesses acquired since December 2011 with the remainder primarily due to increased volume offset by reduced prices,” the company stated.

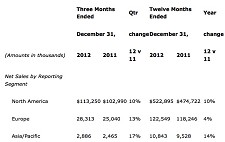

Q4 sales in North America grew 10% to $113.2 million, with an “above-average increase” in the U.S., due in part to the recent acquisitions of Fox Industries and Automatic Stamping.

Q4 sales increases in Europe rose 13% to $28.3 million, primarily due to sales from the recent acquisition of S&P Clever in Europe, partly offset by decreases in France and the U.K.

Sales to contractor distributors and lumber dealers increased in the fourth quarter, while sales to home centers decreased.

Wood construction product sales, including connectors, truss plates, fastening systems, fasteners and shearwalls, totaled $119.5 million represented 83% of total Q4 sales, down from 88% in the fourth quarter of 2011.

Concrete construction product sales, including adhesives, chemicals, mechanical anchors, powder actuated tools and reinforcing fiber materials, totaled $24.9 million, increasing as a percentage of total sales to 17% in the fourth quarter of 2012, up from 11% in the fourth quarter of 2011.

Q4 gross profit increased slightly to $55.2 million. As a percentage of net sales, gross profit dipped from 42% in the fourth quarter of 2011 to 38.2% in the fourth quarter of 2012. The North American gross profit margin decreased from 45.3% in the fourth quarter of 2011 to 42.8% in the fourth quarter of 2012, as a result of competitive price pressure, higher material, factory overhead, shipping and warehouse costs as a percentage of sales and increased concrete construction product sales, which have a lower gross margin than wood construction product sales, although labor costs were lower as a percentage of sales. The European gross profit margin decreased from 31.4% in the fourth quarter of 2011 to 21.2% in the fourth quarter of 2012, primarily due to higher overall costs as a percentage of sales, including severance costs and loss on sale of inventory related to the plant closure in Ireland and exiting the heavy-duty mechanical anchor market in Europe, which accounted for 5.2% and 3.7% of the reduced European gross margin, respectively and 1.0% and 0.7% of the reduced consolidated gross margin, respectively. Increased concrete construction product sales as a percentage of total sales also reduced the gross margin percentage.

While steel prices decreased slightly in the fourth quarter the company expects an increase in steel prices during the first quarter of 2013 due to an expected increase in demand.

In September 2012, Simpson decided to discontinue manufacturing heavy-duty mechanical anchors made in its facility in Ireland and sold in Europe in order to focus on selling light-duty and medium-duty anchors and its fastener products in conjunction with its connector products there. In December 2012 the company ceased producing and selling these heavy-duty mechanical anchors and terminated employees in Europe, primarily in Ireland and Germany, who were manufacturing, selling or supporting the product line.

Overall 2012 net sales increased 8.9% to $657.2 million, boosted by recent acquisitions and increased volumes. Full-year net income fell 17.5% to $42 million

Full-year North America gained 10% to $522.9 million and European sales increased 4% to $122.5 million, with above-average sales to contractor distributors and lumber dealers. ©2013 GlobalFastenerNews.com

Related Stories:

• Fastenal Co. Starts 2013 Strong

• FDI: Anxiety Disappears to Start 2013

• Fastener Sales & Profits Find Their Mark

Related Links:

Share: