FIN STOCK REVIEW

Stock Report: BARNES GROUP

![]()

2012

Barnes Group effectively exited the fastener industry in 2013 when MSC Industrial Direct Co. completed its $550 million acquisition of Barnes’ North American distribution business (BDNA).

Headquartered in Cleveland, OH, BDNA distributes fasteners and other high margin, low cost consumables with a distribution footprint throughout the U.S. and Canada, and 2012 sales of approximately $300 million.

BDNA has a strong presence with customers across manufacturing, government, transportation and natural resources end-markets, servicing roughly 31,000 customers with nearly 1,400 associates, including over 800 field sales associates, and offering more than 55,000 SKUs of products.

During 2012 Barnes Distribution – including BDNA – reported sales fell 1.3% to $350.7 million, while segment operating income rose 14% to $29.4 million.

Barnes Group reported revenue, including fasteners, increased 2% to $306.1 million in the third quarter of 2012. Sales growth included a 5% benefit from the Synventive acquisition, offset by a 1% decrease in organic sales and 2% from unfavorable foreign exchange.

Q3 income from continuing operations dropped 17% to $20.7 million, while net income declined 20.5% to $18.5 million.

Aerospace

Aerospace net sales of $98.4 million were up slightly from last year’s third quarter. An increase in aerospace original equipment manufacturing sales was mostly offset by a decline in aftermarket spare parts sales. Aftermarket repair and overhaul sales were essentially flat compared to a year ago.

Operating profit decreased 5% to $15.3 million, primarily driven by volume mix. The profit impact from lower aftermarket spare parts sales was only partially offset by the profit impact from higher original equipment manufacturing sales. Operating margin declined from 16.4% last year to 15.6% this year.

Industrial

Industrial net sales grew 10% to $123.8 million. The Synventive acquisition provided $15.8 million of sales, while organic sales were relatively flat and unfavorable foreign exchange reduced sales by $4.8 million.

Operating profit was $7.4 million, a decrease of $2.9 million from the third quarter of 2011. The primary driver of the lower operating profit was the impact of $5.1 million of short-term purchase accounting and transaction costs related to the acquisition of Synventive. Reported operating margin was 6%.

Distribution

Distribution net sales declined 5% to $85.7 million due to softness in the company’s North American markets.

Operating profit of $6.9 million decreased 11% primarily due to the profit impact on lower sales volumes. Operating margins decreased 50 basis points to 8.1%.

“During the quarter, we closed on the Synventive deal, the largest acquisition in Barnes Group’s history and we’re pleased with the initial operating performance delivered by this business. We believe that a growing Synventive, coupled with another record level of aerospace backlog, provides us with positive momentum,” stated CEO Gregory Milzcik.

Nine-month revenue gained 1.9% to $886.1 million, with operating income slipping 1.9% to $98.7 million and net income growing 1.3% to $64.6 million.

Barnes Group reported second quarter revenue, including fasteners, decreased 2% to $293.4 million. Organic sales rose 1% in the quarter, offset by a 3% negative impact from foreign exchange. Income from continuing operations for the second quarter grew 9% to $24.8 million.

Q2 orders increased 17% to a record backlog of $642 million.

Overall revenue during the first six months of 2012 gained 1.5% to $596.5 million, with operating income up 4.1% to $67.1 million.

Aerospace

Aerospace sales declined 1% to $93.8 million during Q2. “A slight increase in Aerospace original equipment manufacturing sales and continued strong levels of aftermarket repair and overhaul sales were more than offset by a sales decline in aftermarket spare parts.”

Operating profit decreased 0.6% to $14.7 million in the second quarter, driven by the profit impact of lower sales volumes and a shift in mix. Operating margin improved slightly to 15.7%.

Six-month aerospace revenue increased 3.1% to $191 million, with operating profit improving 1.6% to $28.9 million.

Industrial

Industrial net sales dipped 3.3% to $110.2 million in Q2, which included organic growth of 2%, offset by the unfavorable foreign exchange impact of $6.5 million.

Operating profit increased 2% to $11.2 million in the second quarter, “as a result of the profit impact from higher organic sales at some of the Industrial businesses and lower incentive compensation costs, partially offset by increased pension costs.” Operating margins improved 60 basis points to 10.2%.

Six-month Industrial segment sales edged up 0.1% to $225.6 million, while operating profit slid 2.8% to $21.3 million.

Distribution

Distribution net sales rose slightly to $91.9 million in Q2. Organic sales improved by $1 million, while foreign exchange negatively impacted sales by $900,000.

Operating profit climbed 3% to $8.2 million. Operating margins improved 20 basis points to 8.9% “due to lower incentive compensation expense and higher productivity, partially offset by higher pension costs.”

Six-month Distribution sales gained 2% to $185.3 million, while operating profit jumped 20% to $16.9 million.

Acquisition

On July 16, 2012 Barnes agreed to acquire privately-held Synventive Molding Solutions, which designs and manufactures highly engineered solutions, components, and services for complex injection molding applications, for $335 million cash.

Synventive is one of the world’s largest hot runner systems manufacturers, serving a global customer base of more than 3,000 molders, mold makers and original equipment manufacturers in 50 countries. With estimated 2012 revenues of approximately $160 million, Synventive operates three manufacturing locations in the U.S., Germany and China, with sales and service offices in 28 countries and 770 employees worldwide.

Synventive will operate as a business unit within Barnes Group’s Industrial Segment.

2011

Barnes Group said 2011 was a “great” year, delivering strong growth in sales, profits and backlog.

Barnes reported its Logistics and Manufacturing Services segment, including fasteners, saw sales improve 11% to $492.9 million during 2011. Nearly all of the growth was organic, driven by gains in the aerospace aftermarket business and North American distribution businesses. Segment profit jumped 65.5% to $64.8 million.

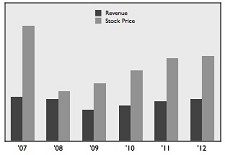

Overall Barnes Group revenue increased 14% to $1.17 billion, while operating income grew 47% to $127.5 million.

In the final quarter of 2011 Barnes sold its Distribution Europe businesses, which included European KENT, Toolcom and BD France, to Germany-based Berner SE for $33.4 million.

2010

Barnes Group said 2010 was a “turning point” for the company. Barnes ended the year with a 7.4% improvement in productivity, which helped drive a 37% improvement in net income. Its backlog grew 12% to $482.1 million.

After double-digit losses in 2009, revenue at Barnes Logistics and Manufacturing Services, including fasten ers at Barnes Distribution, improved 1.7% to $548.5 million, boosted by distribution end-market improvements in North America.

Segment profit fell 16% to $36.9 million.

Overall Barnes Group revenue increased 10% to $1.13 billion, while operating income grew 43% to $86.5 million.

2009

Revenue at Barnes Logistics and Manufacturing Services, including fasteners at Barnes Distribution, slipped 22% to $539.1 million during 2009, hurt by continued weakness in transportation and industrial markets. Segment profit fell 44.5% to $44 million.

In early 2009 Barnes Distribution/North America expanded its stainless steel fasteners product line by 50%, stocking 1,200 new fasteners, including hex head cap screws, socket head cap screws, socket set screws, lock washers and machine screws.

2008

Revenue at Barnes Logistics and Manufacturing Services, including fasteners at Barnes Distribution, slipped 1.6% to $691.8 million in 2008. Segment profit grew 8.6% to $79.1 million during the year.

HISTORY

Barnes Distribution is an MRO distributor with more than 1,000 employees providing general-line MRO supplies in 32 countries.

Barnes Distribution is headquartered at 1301 E. Ninth St. Suite 700, Cleveland, OH 44114. Tel: 216 416-7200 E-mail: info@barnesdistribution.com Web: barnesdistribution.com

Patrick Dempsey is president of Logistics and Manufacturing Services. Dempsey succeeded Idelle Wolf, who retired in 2007. Dempsey joined Barnes Group in 2000 as president of Barnes Aerospace’s Windsor Airmotive Division. In 2004 he was appointed president of Barnes Aerospace and a vice president of parent company Barnes Group.

Barnes Group operates in two segments: Logistics and Manufacturing Services, including Barnes Distribution, which handles 100,000 MRO products, including fasteners, for industrial, heavy equipment and transportation markets; and Precision Components, a global supplier of engineered components for industrial, transportation and aerospace markets.

Barnes Group, which marked its 150th year in 2007, manufactures and distributes precision metal parts and industrial supplies from 68 locations worldwide.

Corporate Office: 123 Main St., Bristol, CT 06011-0489. Tel: 860 583-7070 Fax 860 589-3507

Web: barnesgroupinc.com

CEO: Gregory Milzcik

Key Fastener Executive: Patrick Dempsey, president of Logistics and Manufacturing Services

Employees: 5,110

©2013 GlobalFastenerNews.com

Share: