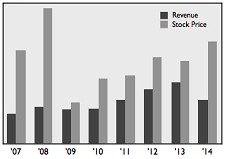

FIN STOCK REVIEW

Stock Report: B/E AEROSPACE

![]()

2014

B/E Aerospace reported commercial aircraft segment (“CAS”) revenues – primarily fasteners – rose 15.4% to $2.06 billion in 2014. Adjusted operating earnings increased 17.1% to $375.1 million, and adjusted operating margin of 18.2% increased 30 basis points. On a GAAP basis, CAS operating earnings were $356.3 million.

Full-year CAS results included fourth-quarter revenue of $480.4 million, adjusted operating earnings of $88.3 million, and adjusted operating margin of 18.4%, and increase of 80 basis points.

“2014 was a defining year in the history of the company,” stated executive board chairman Amin Khoury. “We completed the spin-off of KLX, our consumables management segment, which was comprised of the aerospace distribution and energy services businesses.”

KLX, which began operating as KLX Aerospace Solutions on January 1, 2015, distributes fasteners and other consumable products to over 4,700 global customers.

Overall B/E Aerospace revenue gained 18% to $2.6 billion in 2014, with adjusted operating earnings up 19.8% to $466.4 million and adjusted net earnings up 26.3% to $261.9 million.

KLX distributes aerospace fasteners and provides logistics services.

KLX operates a 62,000 sq ft manufacturing facility in Bridgeport, West Virginia, along with seven distribution centers in the U.S, two in Germany, two in the UK, and one in France.

2013

In May 2014 B/E Aerospace retained Citigroup as its financial advisor to explore “strategic alternatives” – including a “possible sale or merger” of the company, or the “sale, spin-off or other separation of selected businesses within B/E,” or other strategic transactions involving the Company or its businesses.

B/E Aerospace reported Consumables Management segment (CMS) revenue – primarily fasteners – increased 12.2% to $366.6 million in the first quarter of 2014, while operating earnings, adjusted to exclude first quarter acquisition costs, grew 9.6% to $71 million. Operating margin, adjusted to exclude first quarter acquisition costs, was 19.4%.

In 2013, CMS revenue rose 9.3% to $1.28 billion.

CMS operating earnings increased 10.8% to $240 million, and operating margin of 18.7% expanded 20 basis points as compared with the prior year. Operating earnings, adjusted to exclude 2013 acquisition costs, were $245.2 million, an increase of 13.2%. Operating margin, adjusted to exclude both 2013 acquisition costs and AIT costs, was 20.6%, an increase of 60 basis points as compared with the prior year.

Those results included a fourth-quarter CMS sales gain of 7.2% to $323.6 million, with operating earnings, adjusted to exclude 2013 acquisition costs, growing 10% to $60.3 million. Operating margin adjusted to exclude both 2013 acquisition costs and $5 million of integration and transition (AIT) costs related to acquisitions completed in earlier periods, was 20.2% – an increase of 70 basis points.

2012

B/E Aerospace reported first quarter 2013 consumables management segment (CMS) revenues – primarily fasteners – increased 13.9% to $326.7 million, while operating earnings of $64.8 million increased 25%, and operating margin of 19.8% expanded 170 basis points as compared with the prior year period.

Operating margin, adjusted to exclude AIT costs of $4.1 million, was 21.1% and expanded 150 basis points as compared with the prior year period similarly adjusted for AIT costs.

In 2012 CMS revenue increased 24% to $1.17 billion. Operating earnings were $216.7, an increase of 18.4% as compared with 2011. 2012 operating margin of 18.5% decreased by 90 basis points as compared with 2011 due to AIT costs ($17.2) and the acquisitions of UFC and Interturbine which currently have lower operating margins than the legacy CMS business. Operating margin excluding AIT costs was approximately 20.0%, up 10 basis points as compared with 2011.

Fourth quarter 2012 CMS operating earnings rose 28.6% to $54.8 million, while the operating margin of 18.2% was flat as compared with the prior year period. Operating margin was 19.5%.

Overall company revenues rose 23.4% to $3.1 billion.

Operating earnings grew 26% to $540.0 million, and operating margin of 17.5% increased 40 basis points as compared with the prior year.

Consolidated net earnings increased 28% to $291.3 million and $2.83 per share.

B/E Aerospace reported revenue at its Consumables management segment (CMS) — primarily fasteners — climbed 19.5% to $286.6 million in the second quarter, with operating earnings rising 14.9% to $55.5 million.

The second-quarter CMS growth rate, while strong, slowed a bit from the 24.3% rate of growth recorded in the opening quarter of 2012.

Six-month consumables revenue increased 21.8% to $573.4 million, with operating earnings gaining 15.5% to $107.3 million.

In June B/E Aerospace doubled its CMS product portfolio with a $251 million deal to acquire aerospace material management logistical services provider Interturbine of Germany. The acquisition is expected to close in the final quarter of 2012.

Overall Q2 revenues improved 26.1% to a record $768.1 million, boosted by “the robust new aircraft delivery cycle” and acquisitions. Operating earnings jumped 33.1% to $142.0 million, while bookings were approximately $770 million, with the book to bill ratio of 1 to 1.

B/E Aerospace said it expects continued strong orders in 2012 driven by the robust wide-body aircraft delivery outlook, with full-year revenue of approximately $3 billion and EPS of $2.75 per diluted share — a year-over-year increase of 23%.

Six-month revenue gained 25.3% to $1.5 billion, while operating earnings increased 29.4% to $267.6 million.

2011

B/E Aerospace reported Consumables management (CMS) revenue, including fasteners, rose 22.1% to $943.5 million in 2011, with segment operating earnings climbing 19.5% to $183.1 million during the year.

Those results included a 16.7% increase in revenue to $234.1 during the final quarter, with segment operating earnings up 13% to $42.6 million.

CMS adjusted operating earnings were $187.6 million (19.9 percent operating margin), an increase of 19% as compared with 2010. Adjusted organic operating margin, excluding acquisitions, was approximately 20.8%, up 30 basis points. Organic revenue growth, excluding acquisitions, reached 9.3% and excluding both acquisitions and sales to military and business jet customers, revenue growth was 14.6%.

Despite record results, CEO Amin Khoury pointed to the “margin drag from the consumables management segment acquisitions which we have now begun to integrate.”

In recent months the company’s Consumables segment has made several acquisitions, including the $400 million purchase of UFC Aerospace Corp. on January 30, 2012.

Fourth quarter 2011 consumables management segment (CMS) adjusted operating margin was 20.1%, reflecting “the acquisitions of Satair and LaSalle, which have lower operating margins than the legacy CMS business.”

Adjusted organic operating margin for the fourth quarter of 2011 was approximately 20.8%.

Consumables Management results included the late 2010 acquisition of Satair A/S’s aerospace fastener distribution business, for which B/E paid $162 million.

2010

B/E Aerospace reported sales in its Consumables Management segment, including fasteners, climbed 24% to $230.8 million during the first quarter of 2011, while operating earnings rose 21.2% to $44.6 million.

Segment operating margin of 19.3% was 50 basis points lower than the prior year due to the margin drag from the acquired Satair A/S’s aerospace fastener distribution business.

Order rates for consumables continue double-digit growth.

Full-year Consumables revenues declined 3.2% to $772.9

million, “primarily as a result of lower revenues in the first quarter of 2010 as compared with the first quarter of 2009.”

Segment adjusted operating earnings and adjusted operating margin of $157.6 million and 20.4%, respectively, increased by $6.6 million and 150 basis points, respectively.

Full year 2010 Consumables operating earnings were $153.2 million, up 1.5% as compared with 2009.

2009

Sales at B/E Aerospace’s fastener business, Consumables Management, dropped 23.5% to $798.1 million on a proforma basis during 2009. The company said the decline “reflects reduced activity at airline and MRO maintenance facilities, reduced aircraft capacity, a decrease in revenue passenger miles flown, and substantially reduced activity at business jet manufacturers.”

Fastener segment operating earnings fell 21% to $170.8 million, excluding AIT costs.

During 2009 consolidated B/E Aerospace sales dipped 21% to $1.94 billion, with earnings down 25% to $296.1 million.

2008

For 2008 Consumables Management revenue reached $697.3 million, or 33% of overall B/E sales.

HISTORY

In 2008 B/E Aerospace Inc. completed its acquisition of Honeywell’s aerospace fastener distribution business, Honeywell Consumable Solutions, for $1.06 billion, transforming B/E Aerospace into one of the largest distributors of aerospace fasteners in the world.

“The integration of Honeywell’s distribution business with ours is expected to be an important driver of margin expansion and earnings growth for B/E Aerospace over the next three years,” stated B/E Aerospace CEO Amin Khoury. “The combined businesses are expected to generate more than 50% of B/E Aerospace’s operating earnings beginning in 2009, and to steadily increase the distribution segment’s percentage contribution to B/E Aerospace’s operating earnings.” B/E’s new segment, Consumables Management, provides logistics services OEMs, airlines, repair shops, flight service centers and distributors, as well as distributing aerospace fasteners.

As part of the deal, B/E signed a 30-year contract to become Honeywell’s exclusive licensee to sell fasteners, seals and other products, as well as supplying Honeywell’s production facilities.

With a combination of $903.1 million in cash and six million shares of common stock, B/E paid about twice HCS’ $524 million in revenue – reportedly about double the aerospace and defense sector’s price-to-sales ratio of 1.1 to 1.

Consumables Management distributes aerospace fasteners and provides logistics services.

Consumables Management operates a 62,000 sq ft manufacturing facility in Bridgeport, West Virginia, along with seven distribution centers in the U.S, two in Germany, two in the UK, and one in France.

Corporate Office: 1400 Corporate Center Way, Wellington, FL 33414. Tel: 561 791-5000 Fax 561 791-7900

Web: beaerospace.com

Co-CEOs: Werner Lieberherr

Employees: 5,500

©2015 GlobalFastenerNews.com

Share: