5/17/2010

HEADLINES

Stock Report: DORMAN

![]()

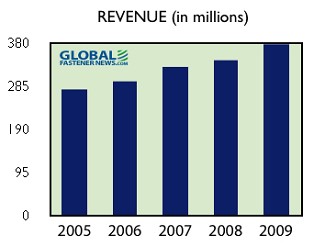

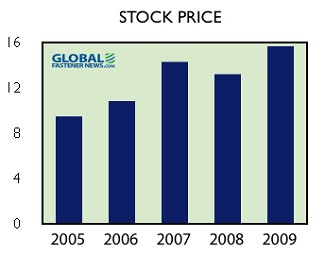

Dorman Products continued its growing revenue, with 2009 sales rising 10% to $377.4 million, “driven by strong overall demand for our products and higher new product sales.”

Full-year net income jumped 49% to $26.5 million.

Those results include a strong fourth quarter performance, as revenue increased 20% to $96.7 million and Q4 income soaring 57% to $7.7 million.

In 2009 the company boosted new product development.

“We are compelled to make hard decisions. This means we will discontinue unprofitable product lines and say no to new sales opportunities that do not provide an adequate return on investment. Our focus for 2009 and beyond is not simply to grow revenue; it is on profitable, enduring, and mutually beneficial growth for us and our customers.”

In 2006 R&B Inc. changed its named to Dorman Products Inc. to “present a sharper image of the company and strengthen its corporate identity by connecting it directly to the company’s strongest brand.” R&B purchased Dorman Products in 1994.

All products are now sold under one of seven Dorman sub-brands. Automotive fasteners are sold under its Auto Grade sub-brand.

Dorman designs, packages and markets 103,000 automotive replacement parts and fasteners, with about 30% of its business coming from OEMs. Customers include AutoZone, Pep Boys, Advance, NAPA, Wal-Mart, Carquest, AutoValue, Home Depot, Lowe’s, salvage yards and local independent wholesalers.

Dorman operates 13 warehouse and office facilities in the U.S., Canada, Sweden, China and Korea. Domestic warehouses are located in Warsaw, KY; Colmar, PA; Louisiana, MO; Baltimore; and Portland, TN.

Corporate Office: 3400 E. Walnut St., Colmar, PA 18915. Tel: 215 997-1800 Fax 215 997-7968

Web: dormanproducts.com

CEO: Richard Berman, 52

Employees: 966

©2010 GlobalFastenerNews.com

Share: