2015

TriMas Corp. reported Aerospace segment sales, including fasteners, jumped 45% to $176.5 million in 2015, with segment gross profit rising 69% to $58.6 million.

Energy segment revenue, including fasteners, declined 6.4% to $193.4 million, with gross income down 33% to $23.7 million.

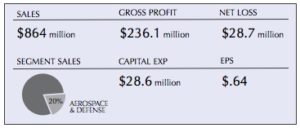

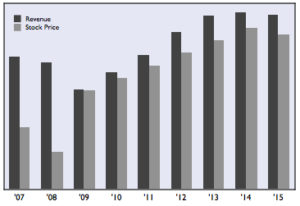

Overall TriMas revenue declined 2.6% to $864 million, with gross profit down 0.3% to $236.1 million.

2014

TriMas Corp. reported revenue in its Aerospace segment – which consists of Allfast Fastening Systems, Monogram Aerospace Fasteners, Mac Fasteners, and Martinic Engineering – increased 28.5% to $35.1 million in the fourth quarter of 2014, primarily due to the results of Allfast, acquired for $360 million in October 2014.”

Aerospace segment revenue rose 27% to $121.5 million.

Weeks after acquiring Allfast Fastening Systems for the “astonishingly high price” of $340 million, TriMas is looking to focus on its core businesses by spinning off Cequent, its towing, trailer cargo management business, into its own company.

The plan calls for Cequent to operate as an independent, publicly held company. The Cequent businesses generated revenue of approximately $614 million – 42% of TriMas revenue – in the aggregate for the trailing 12 month period ended September 30, 2014.

This transaction is expected to be completed during mid-2015.

TriMas CFO Mark Zeffiro will become CEO of the new entity.

Excluding Cequent, TriMas generated revenue of approximately $855 million in the trailing 12 month period ended September 30, 2014, and will continue to be led by CEO Dave Wathen.

“Over the past five years, we have transformed TriMas from a leveraged holding company into a diversified, global manufacturer of engineered and applied products with a track record of consistent growth and operating results,” Wathen explaiend.

“We believe the spin-off will provide both companies greater flexibility to focus on their distinct growth and margin improvement strategies within their respective core markets, enabling them to further improve competitiveness and create significant value for shareholders, customers and employees.”

TriMas’ common stock will continue to be listed on NASDAQ under the symbol “TRS” and the company will remain headquartered in Bloomfield Hills, MI.

Post separation, TriMas expects to have a higher growth and margin profile and will be a more focused, diversified engineered products company, consisting of the current Packaging, Aerospace, Energy and Engineered Components segments.

TriMas’ Aerospace segment, which consists of Allfast, Monogram Aerospace Fasteners, Mac Fasteners, and Martinic Engineering, achieved a 6.1% increase in Q3 sales to $27.4 million, primarily due to the results of the acquisition of Mac Fasteners in October 2013. Segment operating profit fell 39% to $3.9 million.

Nine-month Aerospace segment sales rose 27% to $86.4 million, while operating profit slipped 9% to $14.4 million.

2013

TriMas Corp. reported sales in its Aerospace & Defense segment (consists of Monogram Aerospace Fasteners, Mac Fasteners, Martinic Engineering and NI Industries) rose 29.5% to $101.8 million in 2013.

The increase was prompted by acquisitions (Martinic Engineering in January 2013 and Mac Fasteners in October 2013), along with “improved demand for blind bolts and one-sided installation products resulting from new programs with airplane frame manufacturers and the recent introduction of new products.”

Full-year Aerospace & Defense segment profit gained 14% to $23.8 million.

Fourth-quarter Aerospace & Defense segment sales jumped 48.4% to $30.5 million, while operating profit increased 65% to $8.4 million.

Energy segment sales (consists of Lamons including South Texas Bolt & Fitting, Basrur, CIFAL, Gasket Vedações Técnicas and Wulfrun) improved 8.1% to $205.6 million in 2013, boosted by recent acquisitions and increased sales to engineering and construction customers. Full-year operating profit declined 51% to $8.6 million.

Fourth-quarter Energy segment sales decreased 6% to $44.2 million, primarily due to “the significant slow down and postponement of turnaround activity and maintenance spend in the North American refining and petrochemical end markets.” Q4 operating results produced a $3.9 million loss.

For the year, TriMas reported overall sales gained 9.6% to a record $1.39 billion.

2012Trimas Corp. reported sales increased 17.4% to a record $1.27 billion in 2012.

The company’s Energy segment, which consists of Lamons — including South Texas Bolt & Fitting and CIFAL, saw fourth-quarter and full year 2012 sales increase 14.7% and 14%, respectively, “due to continued market share gains within the highly-engineered bolt product line, additional sales generated by newer branches, the acquisition of CIFAL in Brazil in July 2012 and increased levels of turnaround activity at refineries and petrochemical plants.”

The company’s Aerospace & Defense segment, which consists of Monogram Aerospace Fasteners and NI Industries, reported Q4 sales increased 11.7% on “improved demand for blind bolts and temporary fasteners from aerospace distribution customers resulting from new programs with airplane frame manufacturers, the recent introduction of new products and sales growth in China.”

Aerospace & Defense segment sales for 2012 remained flat as improved demand for blind bolts and temporary fasteners from aerospace distribution customers was offset by lower sales in the defense business.

During 2012, Trimas acquired Brazil-based CIFAL Industrial e Comercial Ltda, which became part of TriMas’ Lamons business.

Founded in 2001, San Paulo-based CIFAL manufactures and supplies specialty fasteners and stud bolts, primarily to the oil and gas industry, generating approximately US$9 million in revenue for the 12 months ended June 30, 2012.

“GVT now allows us to broaden our product offering in country to include gaskets and offers additional opportunities for continued growth, while expanding our footprint in Brazil to be closer to our customers,” commented CEO David Wathen during a February 26 conference call transcribed by Seeking Alpha.

Lamons is part of Trimas’ Energy segment, which saw sales increase approximately 40% for Q4 and 2012. CFO Mark Zeffiro said the increase was prompted by “multiple growth initiatives, including market share when totaling almost 9 million within our highly engineered bolts product line, our July acquisition of CIFAL in Brazil and incremental sales from new branches to support Lamons global customers.”

“We continue to leverage CIFAL and our executing on plans to further support customers in Brazil given the expected growth in the regions Energy sector.”

“Monogram, our aerospace businesses, continues to show positive sales momentum with a double-digit increase in sales to both prior periods, including new sales into Asia,” Zeffiro explained. “We continued to experienced higher order activity, which resulted in record backlog at year end.”

“In Energy, plentiful natural gas needs customer plants are converting from oil to gas as feedstock and concerns about leakage or environmental hazards help increase sales of higher spec seals, gaskets and fasteners,” Zeffiro said.

Aerospace and Defense gains were driven by “new aircraft designs, redesigns of existing platforms and substitution of lighter weight fasteners and parts, all areas we focus on.”

The executives hinted at further acquisition potential.

“We have a fastener capacity issue within Energy, as in the big fastener that we will make a South Texas Bolt in all that,” stated CEO Wathen. “And we need more of that capacity because we are having to outsource things and pay way more than we could manufacture for.”

Trimas estimates 2013 sales will increase 6% to 8% compared to 2012.

2011

TriMas Corp. reported sales for its Aerospace and Defense segment, including Monogram Aerospace Fasteners, increased 6.3% to $78.6 million during 2011, due to higher sales in the company’s blind bolt and temporary fastener product lines to customers rebuilding inventory in response to higher build rates by the airplane frame manufacturers.Segment operating profit edged up to $18.6 million.

Monogram is expanding to include more aerospace fastening products and is increasing its applications and content on planes. “Monogram is well positioned to capture incremental revenue as composite aircraft rates increase.”

Monogram president Brian McGuire retired on March 31, 2012. He will remain a part of the Monogram team “focused on several key projects.”

McGuire was appointed to his current role in 2008.

McGuire was replaced by Monogram COO David Adler, who will assume control of TriMas’ Aerospace and Defense business segment, which includes NI Industries. Adler will report to TriMas CEO David Wathen.

2010

TriMas Corp. reported sales for its Aerospace and Defense segment, including Monogram Aerospace Fasteners, increased 8.3% to $18.5 million during the first quarter of 2011, due primarily to improved demand from aerospace distribution customers.

Segment operating profit declined 17% to $18.09 million, with 2010 EBITDA falling 15% to $20.42 million.

Share: