7/19/2010

HEADLINES

Tariffs on Fasteners and Wire Rod Growing

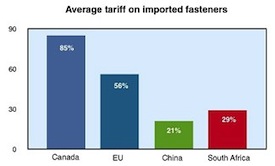

Tariff disputes involving fasteners continue to make headlines as Western nations grapple with Asian producers accused of flooding markets with subsidized screws and bolts.

Tariffs on fasteners and wire rod have grown in the global economic downturn, and not just among major importer and exporter countries. India, Malaysia, Turkey and South Africa have been embroiled in trade disputes, along with the U.S., the European Union, Canada, China and Russia.

EU Fastener Makers Drop Complaints Against India & Malaysia

While hinting at new allegations, European fastener producers have dropped complaints that rivals in India and Malaysia are dumping illegally-subsidized screws and bolts in the European Union, Reuters reports.

The European Industrial Fasteners Institute (EIFI) reportedly withdrew its complaints, filed in August 2009, after European regulators appeared poised to dismiss them.

“The investigations (by EU officials) have shown that there may be a need to enlarge the product scope of trade actions and verification of this will take some more time. That’s why EIFI decided to temporarily suspend (the complaints),” stated Gianni Pezzoli, a member of the group’s executive committee.

The Institute said it is working on filing more extensive complaints in the coming months.

The EIFI complaints covered a similar range to that of the existing stainless steel anti dumping measures – tariff codes 7318 12 10, 7318 14 10, 7318 15 30, 7318 15 51, 7318 15 61 and 7318 15 70. These codes include wood screws, self tapping screws, socket screws and hexagon bolts and screws as well as other screws and bolts with various recesses and heads.

European producers insist imports from India and Malaysia have been soaring since the EU imposed duties on products from other countries.

The EU imported Indian screws and bolts worth EUR 52 million (US$65.50 million) in 2009, up from EUR 2.5 million in 2005. Imports from Malaysia increased more than sevenfold to EUR 15 million during the same period.

In November 2005 the European Union applied antidumping tariffs on imports of threaded stainless fasteners from China, Taiwan, Indonesia, Thailand and Vietnam – tariffs range from 7.7% to 27.4% depending on country and individual producer.

The EU is embroiled in a trade dispute with China, which recently China announced final five-year antidumping duties on steel fasteners imported from the EU.

The tariffs on certain carbon fasteners range from 6.1% to 26%, and affect about EUR 140 million (US$240 million) worth of fasteners.

The move followed China’s decision in December 2009 to apply preliminary tariffs on EU fasteners in retaliation to the European Commission’s adoption of antidumping duties averaging 87% on certain Chinese fasteners. The EU concluded in February 2009 that Chinese producers had flooded the market with fasteners at 30% to 50% below European prices.

Both the EU and China have appealed the tariffs to the World Trade Organization.

China Places Final Tariffs on EU Fasteners

Claiming “substantial damage” to its fastener industry, China announced final five-year antidumping duties on steel fasteners imported from the European Union, AFP reports.

The tariffs on certain carbon fasteners range from 6.1% to 26%, and affect about EUR 140 million (US$240 million) worth of fasteners. Affected EU carbon fasteners include wood screws, self-tapping screws, screws and bolts (with or without nut and wash, excluding screws applied in railway and the screws and bolts which are shorter than 6 mm) and washers.

The move follows China’s decision in December 2009 to apply tariffs on EU fasteners in retaliation to the European Commission’s adoption of antidumping duties averaging 87% on certain Chinese fasteners. The EC concluded in February 2009 that Chinese producers had flooded the market with fasteners at 30% to 50% below European prices.

South Africa Mulls Duty Renewal

South Africa’s tariffs on fasteners are set to expire this year and leaders are evaluating whether to renew duties.

“A change in the duties charged on fasteners brought into South Africa can reduce prices, but will expose South African companies to serious competition from abroad,” wholesaler Trevor Daniel of National Socket Screws told EngineeringNews.co.za.

South Africa’s anti-dumping duties were set to discourage foreign companies from ‘dumping’ excess fasteners there and thus causing price fluctuations.

Daniel said two issues complication extending the tariffs. First, South Africa is a World Trade Organization member country and thus must adhere to rules on trade barriers, and second, there is a required process for renewal.

Duties increase prices to consumers, but South African fastener manufacturers want the protection from imports.

Daniel explained to Engineering News reporter Schalk Burger that Africa may account for only 3% of a developed-country manufacturer’s sales – and thus small compared with other markets.

Imported fasteners arrive at South African ports below local manufacturers’ costs of producing hot-dip galvanised fasteners and that would cut African fastener manufacturing jobs, Hot Dip Galvanisers Association executive director Bob Wilmot told Engineering News.

National Socket Screws is a fastener importer/wholesaler headquartered in East Rand, South Africa. Web: screws.co.za

Russia Initiates Global Antidumping Probe

The Russian Federation of Ministry of Industry & Trade has initiated an antidumping investigation on imported steel bolts and nuts from all countries.

Fastener+Fixing Magazine reported the “special protective investigation reflects concern over the increase in imports of steel bolts and steel nuts to the Russian Federation customs territory.”

The investigation was initiated in response to representations from two Russian enterprises: MMK-Metiz and Severstal-Metiz.

U.S. Tariff Decision Due In Autumn

In the coming weeks the U.S. Court of International Trade is expected to rule on tariff petitions filed by Nucor Fastener in 2009.

Nucor Fastener appealed the unanimous decision by the U.S. International Trade Commission to reject the company’s antidumping and countervailing petitions against certain standard fasteners from China and Taiwan.

In its petitions, filed in September, Nucor Fastener alleged average dumping margins of 145% for Chinese imports, and 74% for imports from Taiwan.

The ITC concluded in its 137-page public report “Certain Standard Steel Fasteners from China and Taiwan” that standard fastener imports did not gain more market share from 2006 to 2008.

A briefing on the appeal is expected this summer, followed by a decision during the autumn of 2010. ©2010 GlobalFastenerNews.com

Share: